WGR Werk, Geldzaken, Recht en de Beurs

Hier kun je alles kwijt over sollicitaties, werksituaties, belastingen, (handelen op) de beurs, hypotheken, beleggingen en salarissen, arbeidscontracten of geschillen met je (huis)baas. Alles over werk, geldzaken en recht dus.

Inhoud:

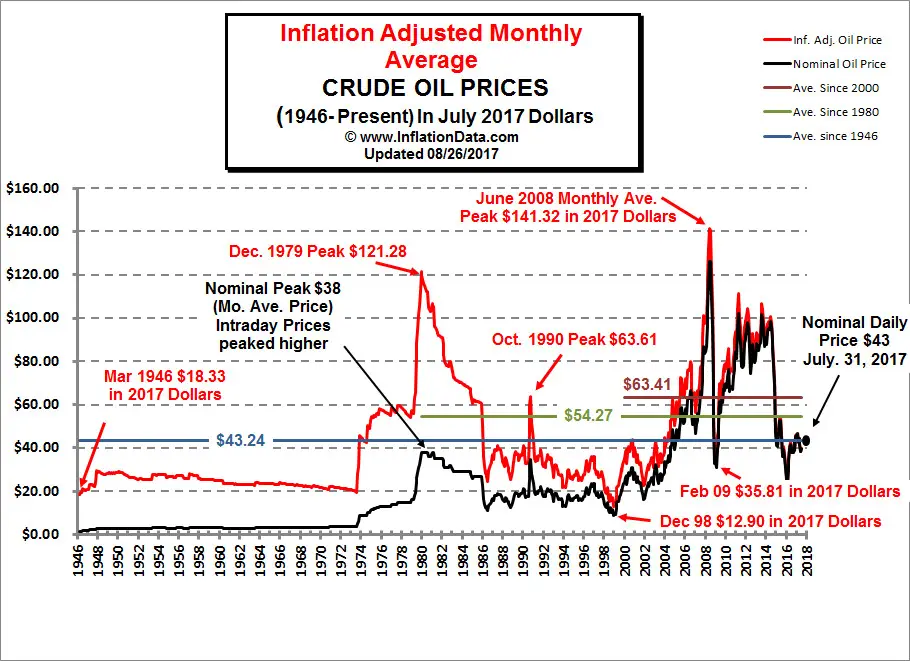

-Recente Olieprijs

-Olieprijs aangepast voor inflatie

-Record

-Vorige topics

-Energie-nieuws

-Officiele energie-gerelateerde instanties

-Olieproductie-grafieken

-Rig Count

-Achtergrond informatie

Recente Olieprijs

Olieprijs aangepast voor inflatie

Record

11 Juli 2008: $147,90

Vorige topics

Prijs vat Olie doorbreekt $ 70

Olie doorbreekt $80 per vat

Olie doorbreekt $90 per vat

Olieprijs op nieuw record: $112 per vat

Olieprijs op recordhoogte: 120 dollar

Olieprijs weer terug op 130 dollar

Olieprijs voor het eerst op 140 dollar per vat

Olieprijs zal sneller stijgen

Energie-nieuws

http://www.321energy.com/

http://www.barchart.com/

http://www.wtrg.com/

http://www.guardian.co.uk/business/oil

http://rigzone.com/news/category.asp?c_id=1

Officiele energie-gerelateerde instanties

DoE: Energy Information Administration

Weekly Petroleum Status Report (Olie-voorraden & olie-import VS, elke woensdag 16:35 Nederlandse tijd)

EIA: Internation Petroleum Monthly (Wereldwijde olieproductie)

Internation Energy Agency

IEA: Oil Market Report (Wereldwijde olieproductie)

IEA: Energieprofiel Nederland

CBS: Industrie & Energie

European Energy Commission

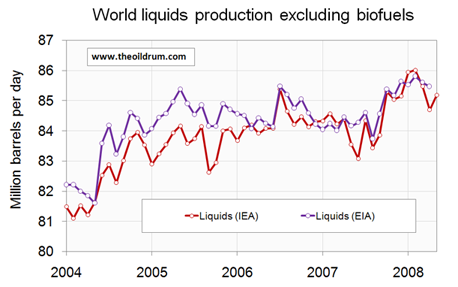

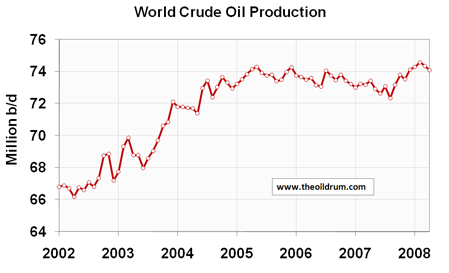

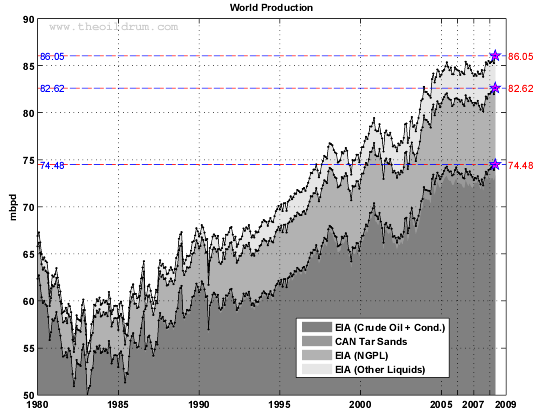

Olieproductie, inclusief non-conventionele productie

Conventionele olieproductie

Rig Count

Achtergrond informatiequote:The oil and gas rig count, which is the number of rigs currently online, is widely regarded as an important indicator in

assessing the health of the oil industry. It can give investors and companies an idea of current demand, as well as provide

clues for the immediate future.

Baker Hughes: Weekly Rig Count

EIA: Oil Market Basics

http://en.wikipedia.org/wiki/Petroleum

http://en.wikipedia.org/wiki/Oil_Megaprojects

http://en.wikipedia.org/wiki/Peak_oil

http://www.theoildrum.com/

http://www.peakoil.com/

"Oil is going up because we use too much oil, and the capacity to replace reserves is dwindling"

- President George W. Bush 7/ 11/ 2007

En we gaan verder...

The problem is not the occupation, but how people deal with it.

Dan is het toch nog heel wat dat er in nederland ooit een betuwelijn is aangelegd.quote:Op dinsdag 26 augustus 2008 17:46 schreef SeLang het volgende:

Dictaturen hebben ťťn groot voordeel boven democratieen en dat is dat ze lange termijn kunnen plannen (in plaats van plannen tot de volgende verkiezingen) en impopulaire maatregelen snel kunnen doorvoeren als dat nodig is voor het lange termijn plan.

Dat we nu de HSL nog steeds niet hebben draaien daar horen we onze overheden maar niet over, want volgens eerdere plannig zou deze al ergens in 2006 operationeel geweest moeten zijn.

Nee, dat ben ik niet.quote:Op dinsdag 26 augustus 2008 18:04 schreef kortsluiting87 het volgende:

TS is blackgold van een ander, niet nader te noemen, forum?

The problem is not the occupation, but how people deal with it.

tvp

The Hick from French Lick

The camera always points both ways. In expressing the subject, you also express yourself.

The camera always points both ways. In expressing the subject, you also express yourself.

Ik denk eerder dat het met pieken en dalen zal fluctueren. De hoge prijs heeft de vraag naar olie verminderd. De lagere vraag heeft de prijs weer laten zakken. De lage prijs doet de vraag weer verhogen, etc..etc..etc.quote:Op dinsdag 26 augustus 2008 19:09 schreef henkway het volgende:

periode van stabilisatie van de olieprijs

http://www.blikopdebeurs.com/weblog1/pivot/entry.php?id=87quote:Orkaan Gustav op ramkoers

26 08 08 - 23:08

De orkaan Gustav zal volgens meteorologen koers zetten van het Caribische gebied naar de Golf van Mexico. Tientallen olievelden en installaties zouden in gevaar kunnen komen. Shell gaat waarschijnlijk woensdag personeel evacueren.

OPEC to try to curb oil price fall in Sept: Iran

edit:

Obama calls for opening of SPR, windfall profits tax

Wat gebeurt er als die 70 miljoen vaten verbruikt zijn? De benzineprijs blijft dan magisch laag? Of zal deze wellicht zelfs hoger terugkeren aangezien de vraag omhoog is gegaan door lagere prijzen?

De SPR is er voor noodgevallen. Voor situaties van leven en dood. Niet om de prijzen kortstondig omlaag te brengen.

Die belasting is ook geen goed idee. Waarom worden bedrijven die het opeens goed doen extra belast? Doen ze iets fout? Willen we ze afmoedigen verder te gaan met hun werkzaamheden? Neen. Het tegenovergestelde. Laat ze hun geld houden zodat ze dit investeren. En Šls je dan toch zo graag het geld van de oliemaatschappijen wil is het laatste wat je moet doen het terug geven aan de consument. Steek het in het ontwikkelen van welke energiebron dan ook nŠŠst fossiele energiebronnen.

[ Bericht 16% gewijzigd door waht op 27-08-2008 10:38:32 ]

Weaker oil demand eases hurricane concernquote:TEHRAN - Iran’s oil minister said on Monday he expects OPEC to work on preventing the falling trend in crude prices and also to study oversupply in the market when it meets in September, oil ministry news website SHANA said.

Iran is traditionally a price hawk and has been at the forefront of rejecting calls for more output from consumers such as the United States, even when prices surged to a record $147 a barrel, a level from which they have now tumbled.

Iran has previously said the market was oversupplied by about 1 million barrels per day (bpd).

Gulf Oil, Gas Hurricane Evacuations to Begin Tomorrowquote:SAN FRANCISCO (MarketWatch) -- Crude-oil futures climbed Tuesday on concerns that Hurricane Gustav will threaten oil production in the Gulf of Mexico, but prices closed off the day's high and fell in electronic trading after the U.S. Energy Department reported weaker year-over-year domestic demand for oil.

Mexico's Cantarell oil output falls again in Julyquote:Aug. 26 (Bloomberg) -- Evacuations of offshore oil and gas rigs and platforms in the Gulf of Mexico will begin tomorrow in preparation for Hurricane Gustav, which may become the strongest storm to hit the region in almost three years.

Transocean Inc., the world's largest offshore oil driller, has begun suspending operations in the Gulf. Royal Dutch Shell Plc is ``making logistical arrangements to evacuate staff who are not essential to production or drilling operations,'' spokesman Destin Singleton said in an e-mailed statement today.

``Shell generally leads off'' the evacuations, said Jim Shugart, executive vice president of ERA Helicopters LLC, which ferries workers to and from offshore facilities. ``They have by far the majority of workers out there and they figure it takes them four to four and a half days to evacuate everybody.''

Southwest to trim 190 flights this winterquote:MEXICO CITY, Aug 26 (Reuters) - Crude output from Mexico's struggling Cantarell oil field fell for the 10th month in a row in July to 974,000 barrels per day, energy ministry data showed on Tuesday.

The fading jewel of Mexico's oil industry, Cantarell is now producing half what it was yielding at its 2004 peak, pulling down overall output in the world's No. 6 oil-producing nation and threatening Mexico's status as a top U.S. supplier.

The steady decline of around 15 percent annually in the field's output has pressured the divided Congress to tweak laws in the closed energy sector. The government, with backing from centrists, hopes to push a bill through Congress to allow more private participation in the state-run oil business.

[..]

Output at Cantarell, a shallow field in the southern Gulf of Mexico, fell in July from 1.018 million bpd in June.

Cantarell, for years the source of 60 percent of Mexico's crude, accounted for 35 percent of Mexico's overall July oil output, down from 36 percent in June.

De olieprijs hangt nu rond de $117.quote:[..]

The airlines are grounding planes and laying off thousands of workers to save money in the face of higher fuel bills.

The Air Transport Association, a trade group for the big carriers, expects U.S. airlines to spend $61.2 billion this year on fuel, up from $41.2 billion last year.

edit:

Obama calls for opening of SPR, windfall profits tax

Erg kortzichtig.quote:During a speech in Lansing, Mich., Obama said he’d like to release up to 10 percent of the 700 million barrels of oil kept in salt caverns in Texas and Louisiana. Obama also called for a revival of the windfall profits tax on oil companies.

[..]

Among the short-term parts of his plan, Obama said: “We should sell 70 million barrels of oil from our Strategic Petroleum Reserve for less expensive crude, which in the past has lowered gas prices within two weeks

[..]

The tax would target “big oil to give families a thousand-dollar rebate,” an announcer in the ad says. Obama has pushed for such a tax to fund $1,000 emergency rebate checks for consumers besieged by high energy costs.

Wat gebeurt er als die 70 miljoen vaten verbruikt zijn? De benzineprijs blijft dan magisch laag? Of zal deze wellicht zelfs hoger terugkeren aangezien de vraag omhoog is gegaan door lagere prijzen?

De SPR is er voor noodgevallen. Voor situaties van leven en dood. Niet om de prijzen kortstondig omlaag te brengen.

Die belasting is ook geen goed idee. Waarom worden bedrijven die het opeens goed doen extra belast? Doen ze iets fout? Willen we ze afmoedigen verder te gaan met hun werkzaamheden? Neen. Het tegenovergestelde. Laat ze hun geld houden zodat ze dit investeren. En Šls je dan toch zo graag het geld van de oliemaatschappijen wil is het laatste wat je moet doen het terug geven aan de consument. Steek het in het ontwikkelen van welke energiebron dan ook nŠŠst fossiele energiebronnen.

[ Bericht 16% gewijzigd door waht op 27-08-2008 10:38:32 ]

The problem is not the occupation, but how people deal with it.

Ik hoorde vandaag dat de daling van de olieprijs deels te verklaren was doordat China i.v.m. de Olympische Spelen 62% van het BBP bevroren had en daardoor nauwelijks olie afnam.

Beetje jammer dat wij er in benzineprijs niets van merken.

Op woensdag 4 februari 2009 20:58 schreef Hoi_Piepeloi het volgende:

Ik dacht altijd dat jij een extreme kutuser was, maar je bent best grappig :+

Ik dacht altijd dat jij een extreme kutuser was, maar je bent best grappig :+

Die laatste foto in de OP.  .

.

"I'm interested in anything about revolt, disorder, chaos, especially activity that appears to have no meaning.

It seems to me to be the road toward freedom. - Jim Morrison"

It seems to me to be the road toward freedom. - Jim Morrison"

Een vaatje Light Sweet Crude Oil kost nu net iets minder dan $117

Raar, als we de volgende nieuwsberichten bekijken:

Russia may cut off oil flow to the West

Gustav 'Likely to Explode into Major Hurricane, Target GOM'

Some fuel terminals have short-term outages

China has head start over West for Iraq oil

Raar, als we de volgende nieuwsberichten bekijken:

Russia may cut off oil flow to the West

Maandag, als Gustav waarschijnlijk de noord-kust van de Golf van Mexico bereikt.quote:Fears are mounting that Russia may restrict oil deliveries to Western Europe over coming days, in response to the threat of EU sanctions and Nato naval actions in the Black Sea.

Any such move would be a dramatic escalation of the Georgia crisis and play havoc with the oil markets.

Reports have begun to circulate in Moscow that Russian oil companies are under orders from the Kremlin to prepare for a supply cut to Germany and Poland through the Druzhba (Friendship) pipeline. It is believed that executives from lead-producer LUKoil have been put on weekend alert.

"They have been told to be ready to cut off supplies as soon as Monday," claimed a high-level business source, speaking to The Daily Telegraph. Any move would be timed to coincide with an emergency EU summit in Brussels, where possible sanctions against Russia are on the agenda.

Gustav 'Likely to Explode into Major Hurricane, Target GOM'

Gulf storm shuts US oil and gas productionquote:Tropical Storm Gustav hasn't deviated from its "very ominous" track toward the U.S. coast of the Gulf of Mexico, and is likely to strengthen into a major hurricane before making landfall, a private forecaster said Thursday.

"This storm remains likely to explode into a major hurricane as it moves across the northwestern Caribbean and into the Gulf over the weekend," said Jim Rouiller, a senior energy meteorologist with weather forecasting firm Planalytics.

[..]

Als komende maandag (of later vandaag) de olieprijzen niet boven de $120 uitvallen weet ik het ook niet meer.quote:The US oil and gas industry began to shut down production in the Gulf of Mexico yesterday after forecasters predicted that tropical storm Gustav would be a hurricane when it hit the region.

Royal Dutch Shell and ConocoPhillips led the majors in evacuating personnel and ceasing production.

The Gulf produces 20 per cent of US oil and gas supplies. Prices in New York topped $120 a barrel but fell after the International Energy Agency said strategic stocks would be released if disruptions were serious.

Jeffrey Rubin, chief economist at CIBC World Markets, said production had not returned to the 2005 levels before Katrina and Rita struck. The Gulf produces 1.3m barrels per day of oil, down from 1.6m then.

[..]

Some fuel terminals have short-term outages

Het Midwesten van Amerika was vorig jaar ook al slachtoffer van brandstof-tekorten. (Zie eerdere posts over de olievoorraden) Labor Day is komende maandag (1 september) en is het einde van het 'Driving Season' van de Amerikanen.quote:BISMARCK, N.D. - Industry officials say they are mystified by fuel shortages at terminals in the Upper Midwest in recent days, but they expect enough supplies for the Labor Day holiday weekend.

Terminals have run out of fuel in West Fargo and Grand Forks in North Dakota; Alexandria, Minn.; and Sioux Falls, S.D.

Officials are trying to figure out why.

[..]

China has head start over West for Iraq oil

August 2008: Production Forecasts and EIA Oil Production Numbersquote:DUBAI (Reuters) - China crossed the line first in the race for big oil contracts in post-Saddam Iraq and has gained a head start over Western oil majors in the competition for future energy deals.

China's biggest oil company, state-run CNPC, agreed a $3 billion service contract with Iraq on Wednesday.

[..]

Starved of investment since the Gulf War of 1990-1991 and the subsequent U.S.-led invasion of 2003 that removed former President Saddam Hussein, Iraq holds some of the world's last large, cheap, untapped oil reservoirs.

[..]

The problem is not the occupation, but how people deal with it.

Europa / de NAVO is gewoon heel dom bezig met die bedreigingen richting Rusland, we zijn enorm afhankelijk van ze (geworden)...

For great justice!

Erst das ÷l und dann die Moral?

Op donderdag 28 augustus 2008 14:34 schreef Breathtaking het volgende:

:9~

:9~

In Zweden betekent Ųl (in Noorwegen Ýl) overigens bier

Op donderdag 28 augustus 2008 14:34 schreef Breathtaking het volgende:

:9~

:9~

Ik snap ook niet waarom ze zich zo vijandig opstellen. De EU-leiders moeten toch weten dat het grootste deel van onze olie-import[1] uit Rusland komt. Maar het is natuurlijk wel zo dat het twee kanten op werkt. Zonder de EU loopt Rusland veel inkomsten mis. Bovendien is de Russische economie ook aan het inleveren.quote:Op vrijdag 29 augustus 2008 10:42 schreef Q. het volgende:

Europa / de NAVO is gewoon heel dom bezig met die bedreigingen richting Rusland, we zijn enorm afhankelijk van ze (geworden)...

[1]Crude Oil Imports EU-25 (XLS)quote:``The emerging markets in general have a lot more risk than people are factoring in over the next 12 months. But I think Russia particularly could really shock some people on the downside'' because ``there's no transparency, no business ethics,'' and ``it is very resource-dependent.''

Bron: Michael Aronstein, chief investment strategist at Oscar Gruss & Son Inc.

Data uit 2005, deel van de olie-import:

Rusland 30,11%

Noorwegen 17,07%

Saudie ArabiŽ 10,63%

LibiŽ 9,01%

Iran 6,11%

The problem is not the occupation, but how people deal with it.

de olie staat nu op 115 en lijkt daar te blijven ... en ik denk dat je gewoonweg moet erkennen dat die opgezweepte onzin van het paniekerig reageren op zogenaamde olietekorten-berichtgeving (stormpje in de golf van mexico of wat uitspraken in het midden-oosten) en de rpijsstijgingen niet meer zo werken...quote:Op vrijdag 29 augustus 2008 10:19 schreef waht het volgende:

Als komende maandag (of later vandaag) de olieprijzen niet boven de $120 uitvallen weet ik het ook niet meer.

zolang de dollar daalt is het voor beleggers een perfecte uitvlucht met een veilig 'win-all' vooruitzicht (immers een eventueel herstel van de dollar zal bij olieprijsdalingen juist dat weer opheffen)..

olie als het perfecte onderpand bij een instabiele monetaiore markt....

met daadwerkelijk aanbod heeft de olieprijs als deze boven de 100 dollar komt, weinig meer te doen.

los ervan of je in 'peak-oil'-beweringen etc. gelooft, dat staat geheel los van de marktontwikkelingen nu.

"Whatever you feel like: Life’s not one color, nor are you my only reader" - Ausonius, Epigrammata 25

En daar ben ik het niet mee eens.quote:Op vrijdag 29 augustus 2008 11:13 schreef RM-rf het volgende:

met daadwerkelijk aanbod heeft de olieprijs als deze boven de 100 dollar komt, weinig meer te doen

Maar goed, ik wacht rustig af.

The problem is not the occupation, but how people deal with it.

Dat gaat toch nog een grote worden, die Gustav.

Upgraded naar catagorie 4

Upgraded naar catagorie 4

"If you want to make God laugh, tell him about your plans"

Mijn reisverslagen

Mijn reisverslagen

Jep ik zit net ook met grote ogen te kijken. Binnen een paar uur is het een categorie 5. Ik vrees voor de bevolking van Louisiana & voor de olie-infrastructuur in en rondom de Golf.

The problem is not the occupation, but how people deal with it.

Had ik dus toch wat oliecontractjes moeten kopenquote:Op zaterdag 30 augustus 2008 22:44 schreef waht het volgende:

Jep ik zit net ook met grote ogen te kijken. Binnen een paar uur is het een categorie 5. Ik vrees voor de bevolking van Louisiana & voor de olie-infrastructuur in en rondom de Golf.

Er was een tijd dat ik gewoon 4000 barrels kocht om te gokken op dit soort dingen.

Sometimes you win, sometimes you lose, maar het blijft dus gewoon gokken.

"If you want to make God laugh, tell him about your plans"

Mijn reisverslagen

Mijn reisverslagen

Als ik het goed heb wordt er maandag niet gehandeld in de VS (Labor Day), maar wel in Europa natuurlijk.quote:Op zaterdag 30 augustus 2008 22:49 schreef SeLang het volgende:

[..]

Had ik dus toch wat oliecontractjes moeten kopen

Er was een tijd dat ik gewoon 4000 barrels kocht om te gokken op dit soort dingen.

Sometimes you win, sometimes you lose, maar het blijft dus gewoon gokken.

Oil companies evacuate Gulf workers as Gustav looms

quote:British oil group BP and US rivals ConocoPhillips and Shell on Thursday evacuated workers from their energy installations in the Gulf of Mexico, as Tropical Storm Gustav loomed.

[..]

According to oil industry analyst Andy Lipow, based in Houston, Texas, Gustav could interrupt 75 percent of the Gulf's crude oil production, or more than one million barrels per day.

De olieproductie in de Golf is er sinds Katrina nog steeds niet bovenop gekomen.

The problem is not the occupation, but how people deal with it.

SMIT International kopen is ook een leuke als je op een orkaanseizoen in wilt zetten. Alleen moet je wel geduld hebben, die hebben nog steeds vele miljoenen van BP tegoed dankzij orkaan Katrina en boorplatform Thunder Horse.quote:Op zaterdag 30 augustus 2008 22:49 schreef SeLang het volgende:

[..]

Had ik dus toch wat oliecontractjes moeten kopen

Er was een tijd dat ik gewoon 4000 barrels kocht om te gokken op dit soort dingen.

Sometimes you win, sometimes you lose, maar het blijft dus gewoon gokken.

Abre los ojos

Sja, het probleem is natuurlijk dat je die orkanen helemaal niet kunt voorspellen. Je hebt een bepaalde kans op een orkaan van een bepaalde sterkte in een bepaald gebied, en gemiddeld zit dat al ingeprijsd. Maar individuele orkanen kun je niet voorspellen.quote:Op zaterdag 30 augustus 2008 23:59 schreef MrUnchained het volgende:

[..]

SMIT International kopen is ook een leuke als je op een orkaanseizoen in wilt zetten. Alleen moet je wel geduld hebben, die hebben nog steeds vele miljoenen van BP tegoed dankzij orkaan Katrina en boorplatform Thunder Horse.

Ik heb zelf bijvoorbeeld in 2006 in het orkaanseizoen toen er geen orkaan in zicht was gegokt op een nieuwe orkaan (met katrina uit 2005 vers in het geheugen). Ik werd beloond met de oorlog in Libanon, die ook niet echt voorspelbaar was maar wel de olieprijs opdreef (op zichzelf ook vreemd, want er zit daar nieteens olie). Dus door een aantal mazzeltjes toen dikke winst gemaakt. Vervolgens een paar weken later alles weer verloren toen hedgefund Amerath failliet ging en als een gek alle longposities in olie moest omdraaien (=enorme prijsdruk). Ook niet direct te voorzien.

Oftewel, als je geen intelligente strategie hebt is het gewoon een pure gok en ben je gewoon het slaafje van onvoorspelbare factoren

"If you want to make God laugh, tell him about your plans"

Mijn reisverslagen

Mijn reisverslagen

KIopt, het is ook puur gokken. De voorspelkracht van de huidige orkaanseizoen-modellen is ook nog eens zeer beperkt. De oliemarkt is dermate efficient dat je hoogstens op een overtuigende mening van je in kunt zetten, waar de rest van de markt het nog niet mee eens is.quote:Op zondag 31 augustus 2008 00:28 schreef SeLang het volgende:

[..]

Sja, het probleem is natuurlijk dat je die orkanen helemaal niet kunt voorspellen. Je hebt een bepaalde kans op een orkaan van een bepaalde sterkte in een bepaald gebied, en gemiddeld zit dat al ingeprijsd. Maar individuele orkanen kun je niet voorspellen.

Ik heb zelf bijvoorbeeld in 2006 in het orkaanseizoen toen er geen orkaan in zicht was gegokt op een nieuwe orkaan (met katrina uit 2005 vers in het geheugen). Ik werd beloond met de oorlog in Libanon, die ook niet echt voorspelbaar was maar wel de olieprijs opdreef (op zichzelf ook vreemd, want er zit daar nieteens olie). Dus door een aantal mazzeltjes toen dikke winst gemaakt. Vervolgens een paar weken later alles weer verloren toen hedgefund Amerath failliet ging en als een gek alle longposities in olie moest omdraaien (=enorme prijsdruk). Ook niet direct te voorzien.

Oftewel, als je geen intelligente strategie hebt is het gewoon een pure gok en ben je gewoon het slaafje van onvoorspelbare factoren

Abre los ojos

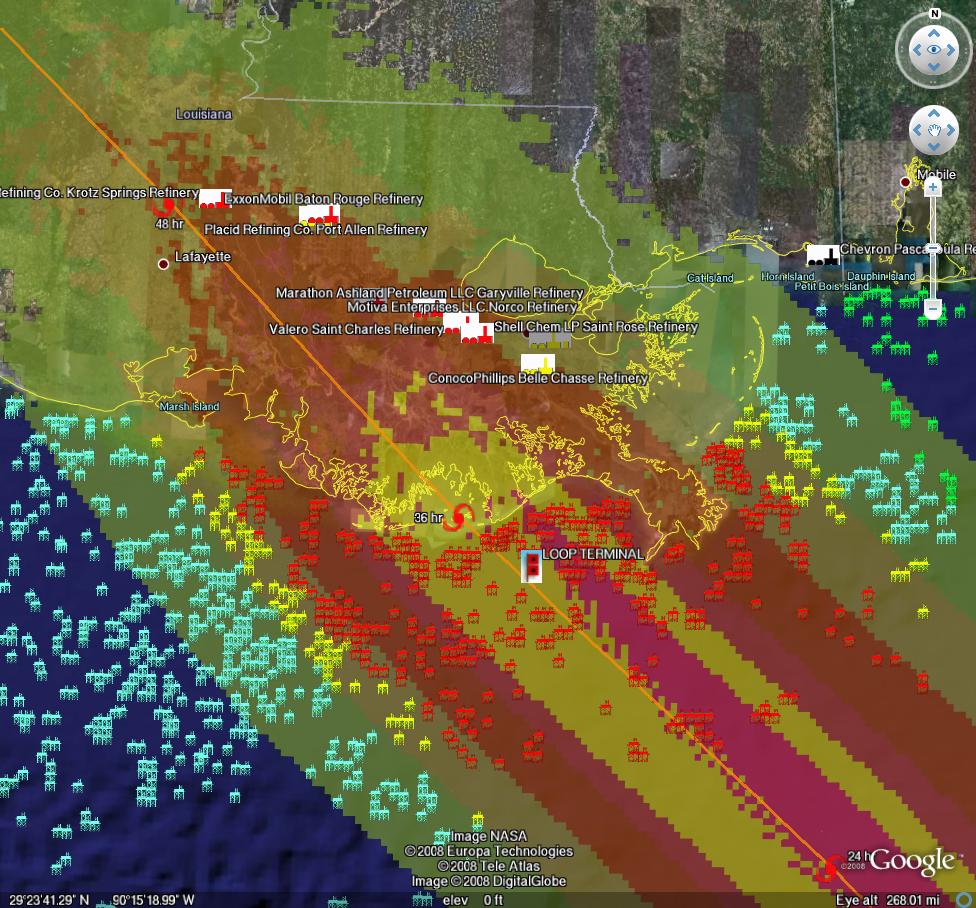

quote:Graphic below is damage models based on official NHC hurricane forecast track, key is below. Numbers are below the fold.

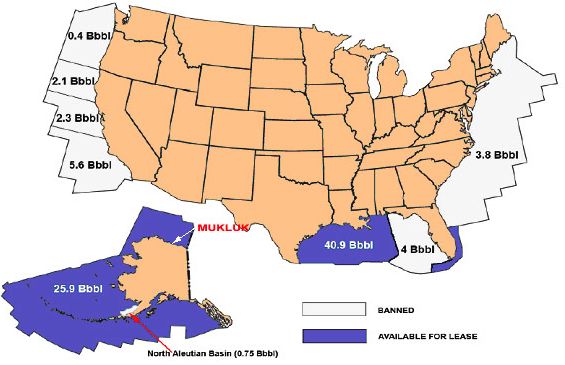

Precies over de Louisiana Offshore Oil Port.

Hier nog een plaatje van de locaties van de Strategic Petroleum Reserve:

Bevatten op dit moment 707 miljoen vaten ruwe olie, maar er zitten ook nog 305 miljoen vaten ruwe olie in commerciŽle reserves. Het probleem is dan ook vooral benzine, waar relatief weinig van beschikbaar is.

The problem is not the occupation, but how people deal with it.

Olieprijs daalt.

Nu $114.76

Nu $114.76

"If you want to make God laugh, tell him about your plans"

Mijn reisverslagen

Mijn reisverslagen

Dus misschien toch lagere vraag door gesloten raffinaderijen,quote:

The problem is not the occupation, but how people deal with it.

Nu zelfs $113.73

Maar de handel is nu erg dun dus dat zegt niet zoveel.

Maar de handel is nu erg dun dus dat zegt niet zoveel.

"If you want to make God laugh, tell him about your plans"

Mijn reisverslagen

Mijn reisverslagen

Morgen handelen de Amerikanen ook weer mee, ik ben benieuwd.quote:Op maandag 1 september 2008 13:19 schreef SeLang het volgende:

Nu zelfs $113.73

Maar de handel is nu erg dun dus dat zegt niet zoveel.

Met Katrina ging het duidelijk anders;

Katrina set to raise oil prices

Storm worsens oil, gas problemsquote:Oil prices touched a fresh record high of $68 a barrel last week, as Hurricane Katrina approached the region.

Oil prices close to record as Katrina shuts down productionquote:Prices had reached as high as $70.85, an intraday high on Nymex, although still below the inflation-adjusted high of about $90 a barrel that was set in 1980.

Maarja, het is nu een andere wereld, een andere VS, andere omstandigheden.quote:Shell, the Gulf's largest producer, said two of its drilling rigs were adrift. It had evacuated almost 1,000 employees and shut down production of 420,000 barrels a day.

The problem is not the occupation, but how people deal with it.

Toen zaten we ook nog meer aan het begin van de bubble.

In een beginfase grijpen mensen nieuwsberichten aan als excuus om te kopen.

In de leegloopfase grijpen mensen nieuwsberichten aan als excuus om te verkopen.

Helaas zijn die dingen meestal pas obvious after the fact

In een beginfase grijpen mensen nieuwsberichten aan als excuus om te kopen.

In de leegloopfase grijpen mensen nieuwsberichten aan als excuus om te verkopen.

Helaas zijn die dingen meestal pas obvious after the fact

"If you want to make God laugh, tell him about your plans"

Mijn reisverslagen

Mijn reisverslagen

$109.16

Benzineprijs stort ook in: $2.6920 (-0.1622).

Kut, gisteren net getankt

Benzineprijs stort ook in: $2.6920 (-0.1622).

Kut, gisteren net getankt

"If you want to make God laugh, tell him about your plans"

Mijn reisverslagen

Mijn reisverslagen

Ik droomde laatst dat het richting de $ 200 ging

Op donderdag 28 augustus 2008 14:34 schreef Breathtaking het volgende:

:9~

:9~

Drama!

Benzineprijs stort in: $2.6806 ( = 17,36 cent eraf ). Het lijkt wel het kwartje van Kok!

Crude Oil: $108.46 ( -$7.00 )

Benzineprijs stort in: $2.6806 ( = 17,36 cent eraf ). Het lijkt wel het kwartje van Kok!

Crude Oil: $108.46 ( -$7.00 )

"If you want to make God laugh, tell him about your plans"

Mijn reisverslagen

Mijn reisverslagen

quote:Op dinsdag 2 september 2008 09:54 schreef SeLang het volgende:

Drama!

Benzineprijs stort in: $2.6806 ( = 17,36 cent eraf ). Het lijkt wel het kwartje van Kok!

Crude Oil: $108.46 ( -$7.00 )

De goedkope olie komt terug

Crude Oil: $106.60

Gasoline: $2.6343 (-0.2199)

§ = $1.4493

Shortsqueeze als je het mij vraagt

Gasoline: $2.6343 (-0.2199)

§ = $1.4493

Shortsqueeze als je het mij vraagt

"If you want to make God laugh, tell him about your plans"

Mijn reisverslagen

Mijn reisverslagen

$105.64

Gaan we de $100 nog halen vandaag?

Gaan we de $100 nog halen vandaag?

"If you want to make God laugh, tell him about your plans"

Mijn reisverslagen

Mijn reisverslagen

Hopelijk... Zien we daar aan de pomp nog wat van?quote:Op dinsdag 2 september 2008 10:38 schreef SeLang het volgende:

$105.64

Gaan we de $100 nog halen vandaag?

Het is van tijdelijke aard, volgende week moet ik weer tanken en dan stijgt het weer.

The Hick from French Lick

The camera always points both ways. In expressing the subject, you also express yourself.

The camera always points both ways. In expressing the subject, you also express yourself.

Commentaar overbodigquote:OPEC considers cutting oil production

Sunday September 7, 1:34 pm ET

By George Jahn, Associated Press Writer

OPEC ministers consider options including output cuts as oil prices fall

VIENNA, Austria (AP) -- With oil prices off nearly 30 percent from their highs of almost $150 a barrel, OPEC oil ministers are considering what was unthinkable just a few weeks ago -- cutting back output to prop up the price of crude.

No one is predicting much of a cutback -- if any at all. Still, such a move would not even have been thought of with oil prices setting record after record back in July.

But the bull run appears to have paused, if not ended, which means a new look at options for Tuesday's meeting of the 13 ministers at OPEC's Vienna headquarters.

Since crude surged to a record $147.27 a barrel on July 11, it has tumbled by over $40, or more than 27 percent. Back then, OPEC's main concern was pushing back against arguments from the U.S. and other key consumers that an output increase was needed to end rocketing prices. Oil ministers insisted there was adequate supply to meet demand, and blamed speculators and a weak U.S. dollar for crude's stellar rise.

But now, the greenback has strengthened, world demand has decreased due to creaky economies, traders' appetites for commodities have cooled -- and suddenly the market appears to have turned bearish. Oil markets, however, will also be keeping a close eye on Hurricane Ike, which on Sunday was an extremely dangerous Category 4 storm projected to move into the oil-producing Gulf of Mexico after passing over Cuba.

Light, sweet crude for October delivery fell $1.66 to settle at $106.23 a barrel Friday on the New York Mercantile Exchange -- its lowest close since early April.

The downward spiral has led to calls from OPEC price hawk Iran -- the group's second-largest producer -- to reduce output from the nearly 30.5 million barrels a day being pumped last month by the organization's members.

Not far behind is Venezuela. While moderating recent demands for immediate output cuts, Venezuelan Oil Minister Rafael Ramirez has drawn the line at $100 per barrel of oil. Anything below that should serve as a wake-up call for OPEC to tighten the spigots, he says -- sentiment that is shared by other OPEC members.

Still, a major cutback is unlikely without Saudi compliance, and the Saudis -- de-facto OPEC policy setters who are now producing nearly a third of total OPEC output -- have given no hint they favor that option. Saudi Oil Minister Ali Naimi has instead talked about a floor of $80 as the red line for action.

OPEC has reason to be cautious.

Despite their precipitous fall, prices remain 14 percent higher this year than in 2007, and a barrel of benchmark crude still fetches four times what it did five years ago.

Any OPEC move Tuesday to pare back output would send a howl of protest from the U.S. and other major consumers, and give a larger platform to Republican presidential candidate John McCain and Barack Obama, his Democratic counterpart, to call for reduced dependence on foreign oil.

Additionally, OPEC understands that high prices drive down demand and will likely try to find a balance between high profits and a price that the market can accept.

In a forecast last month, OPEC predicted that the world's forecast appetite for oil for this year overall will have fallen by 30,000 barrels a day and noted that world demand growth next year will be "the lowest since 2002." And on Wednesday, the U.S Energy Administration reported a 3.5 percent drop for products including gasoline and other oil-based products compared with last year.

Such factors have led some experts to predict OPEC would opt for no change.

"The ministers will hold the status quo (although) there is going to be the usual jawboning from the usual suspects" for a cutback, said oil analyst and trader Stephen Schork. Even now, "oil is by no means cheap and that is certainly adding a lot of pressure to the (world's) economies -- the smarter ones, the Saudis, the Qataris the Kuwaitis are aware of this."

Others think that OPEC, which accounts for about 40 percent of world oil production, will compromise between doing nothing -- thereby chancing a further erosion in prices -- and slashing boldly -- thereby risking skyrocketing prices and an ensuing fallback in demand.

That middle way would mean agreeing to pare away at overproduction without reducing the overall output quota of 27.3 million barrels a day set in November for the 10 OPEC members under production limits.

Energy analyst Catherine Hunter of Global Insight estimates overproduction at between 600,000 and 800,000 barrels a day and says this is the likely "first target of cuts." And because most of the extra production comes from Saudi wells, such a move could be easily accepted by most OPEC members.

"Ultimately, OPEC wants to know what the market will bear," she wrote in a recent analysis, adding that with the world's developed economies expected to perform poorly -- and a resulting overspill to East Asian markets -- "the answer may well be, not much."

Chip Hodge, portfolio manager with MFC Global Investment Management, also thinks that if OPEC issues a call for cuts it will be in overproduction, adding the organization has little additional wiggle room.

"Oil prices are still higher than where they were a year ago," he said. "They just don't have much to complain about."

"If you want to make God laugh, tell him about your plans"

Mijn reisverslagen

Mijn reisverslagen

De dollar stijgt als de olie zakt... In euro's zal de grafiek minder extreem stijgen/dalen.quote:Op dinsdag 2 september 2008 19:33 schreef Bulletdodger het volgende:

[..]

Hopelijk... Zien we daar aan de pomp nog wat van?

censuur :O

Light Sweet Crude Oil op dit moment $104 per vat, rond de 73,75 euro.

Brent is al onder de $100 gezakt samen met Urals & Forties. (Klik)

Verder is de nieuwe IPM van het EIA uit. http://www.eia.doe.gov/ipm/supply.html

Niet veel speciaals te melden. Mei 2008 blijft staan als de maand waarin het meeste olie is gewonnen, en waarin het totale olieaanbod het hoogste lag, voorlopig.

EIA Report on Hurricane Impacts on U.S. Energy

Guardian: Angola: blood oil and western hypocrisy

Will rising fuel costs reverse globalization?

Brent is al onder de $100 gezakt samen met Urals & Forties. (Klik)

Verder is de nieuwe IPM van het EIA uit. http://www.eia.doe.gov/ipm/supply.html

Niet veel speciaals te melden. Mei 2008 blijft staan als de maand waarin het meeste olie is gewonnen, en waarin het totale olieaanbod het hoogste lag, voorlopig.

EIA Report on Hurricane Impacts on U.S. Energy

Guardian: Angola: blood oil and western hypocrisy

Dan nu de hamvraag; waar hechten we meer waarde aan, het stoppen van misdaden tegen de mensheid in Afrika, of het laten rijden van onze auto's?quote:Western powers are selective in their censure of African regimes guilty of misrule, while ignoring those countries with oil, or who are allies in the US "war on terror". For example, Robert Mugabe has been rightly pilloried by the west for running Zimbabwe into the ground. Yet Mugabe's great ally, Angola's Eduardo dos Santos, whose ruling MPLA is going into a parliamentary election today, has an equally appalling record of autocratic rule. But Angola's fabulous oil wealth has silenced western criticisms of the regime's terrible human rights abuses.

[..]

It is now clear that oil wealth protects African dictators from international pressure to democratise.

[..]

Unless the west tackles these obvious blindspots, their criticisms of African misrule, although desperately needed, will ring hollow.

Will rising fuel costs reverse globalization?

quote:[..]

A subject of lively debate among economists and business analysts today is the effect of rising oil prices on globalization. Rising oil prices translate into higher fuel costs, and that in turn drives up shipping costs. Ninety per cent of global demand for crude is based on the need for transportation fuels. In a world of triple-digit oil prices, could it cost less to manufacture products more expensively at home rather than ship cheaper products half way around the world? Could rising oil prices slow, stall, or even reverse the trend of globalization?

[..]

Rising oil prices provide a powerful case for proximity. Mexico should become more attractive for outsourcing manufacturing of goods where transportation to market is a substantial part of the cost, such as heavy industrial equipment, furniture and clothing. By the same reasoning, the U.S. should become even more attractive to Canada as an export market.

[..]

The problem is not the occupation, but how people deal with it.

OPEC verlaagt olieproductie

Uitgegeven: 10 september 2008 07:27

WENEN - De Organisatie voor Olie Exporterende Landen (OPEC) heeft besloten de olieproductie de komende veertig dagen met 520.000 vaten per dag te verminderen.

Dit maakte de organisatie woensdagochtend vroeg bekend na overleg in de Oostenrijkse hoofdstad Wenen, waar de OPEC is gevestigd.

De reductie komt op een moment dat de prijs voor een vat olie sterk daalt. Met de vermindering gaat de productiehoeveelheid weer naar het niveau van september vorig jaar.

OPEC-president Chakib Khelil kondigde aan dat de organisatie er streng op zal toezien dat de lidstaten niet meer produceren dan afgesproken.

Lidmaatschap

De OPEC maakte verder bekend dat IndonesiŽ heeft besloten zijn lidmaatschap van de organisatie op te schorten. Van de OPEC zijn nu nog twaalf landen lid.

(c) ANP

bron: nu.nl

ik snap het nut hiervan niet, vindh et zowiezo ook lame dat de brandstofprijs aan de pomp niet mee naar beneden gaat, maar wel meteen omhoog gaat als de prijs omhoog gaat.

Uitgegeven: 10 september 2008 07:27

WENEN - De Organisatie voor Olie Exporterende Landen (OPEC) heeft besloten de olieproductie de komende veertig dagen met 520.000 vaten per dag te verminderen.

Dit maakte de organisatie woensdagochtend vroeg bekend na overleg in de Oostenrijkse hoofdstad Wenen, waar de OPEC is gevestigd.

De reductie komt op een moment dat de prijs voor een vat olie sterk daalt. Met de vermindering gaat de productiehoeveelheid weer naar het niveau van september vorig jaar.

OPEC-president Chakib Khelil kondigde aan dat de organisatie er streng op zal toezien dat de lidstaten niet meer produceren dan afgesproken.

Lidmaatschap

De OPEC maakte verder bekend dat IndonesiŽ heeft besloten zijn lidmaatschap van de organisatie op te schorten. Van de OPEC zijn nu nog twaalf landen lid.

(c) ANP

bron: nu.nl

ik snap het nut hiervan niet, vindh et zowiezo ook lame dat de brandstofprijs aan de pomp niet mee naar beneden gaat, maar wel meteen omhoog gaat als de prijs omhoog gaat.

Je snapt het nut ervan niet? Dat is toch niet zo moeilijk.  olieprijs daalt, vraag daalt --> inkomsten OPEC-landen dalen fors.

olieprijs daalt, vraag daalt --> inkomsten OPEC-landen dalen fors.

Productie verminderen --> olieprijs stijgt --> inkomsten stijgen.

Productie verminderen --> olieprijs stijgt --> inkomsten stijgen.

Toch fijn dat je met samenwerken toch een monopolie positie kan innemen en de vrije markt gewoon een dikke vinger kan geven.quote:Op woensdag 10 september 2008 09:34 schreef ItaloDancer het volgende:

Je snapt het nut ervan niet? Dat is toch niet zo moeilijk.olieprijs daalt, vraag daalt --> inkomsten OPEC-landen dalen fors.

Productie verminderen --> olieprijs stijgt --> inkomsten stijgen.

Wie mailt dit topic even naar haar?

Op donderdag 28 augustus 2008 14:34 schreef Breathtaking het volgende:

:9~

:9~

Olie uit Dubai & Oman is nu ook onder de $100 gezakt. (Klik)

Democrats look to more drilling

Oil ends at 5-month low on OPEC talk

Hurricane destroys oil infrastructure; oil price falls

Democrats look to more drilling

Gulf workers evacuate offshore facilities, againquote:WASHINGTON - With public opinion shifting toward offshore drilling, Democrats are looking to defuse the volatile election issue by allowing oil companies for the first time to explore off the Atlantic and Gulf coasts from Virginia to Florida — but only if they foot the bill for new alternative energy programs.

House Speaker Nancy Pelosi, who not long ago staunchly opposed lifting any of the offshore drilling bans, said Tuesday she now supports an energy package that would including drilling in federal waters off the southeastern coast. She is planning a vote that could come as early as Friday.

Shell agrees landmark 4.0 bln-dlr gas deal with Iraqquote:Less than two weeks after evacuating thousands of offshore workers from production platforms and other facilities, Exxon Mobil Corp., Royal Dutch Shell and others were again removing workers from their posts Tuesday as Hurricane Ike approached.

Mooi, niet meer affakkelen.quote:BAGHDAD (AFP) - Royal Dutch Shell will form a gas venture with energy-rich Iraq worth up to four billion dollars, the oil ministry said Tuesday of the first Western oil major to do a deal with the central government since the 2003 invasion.

The venture to capture unwanted gas burned off during oil production, for domestic consumption and export, is expected to be signed in Baghdad next month, ministry spokesman Assem Jihad told AFP.

Oil ends at 5-month low on OPEC talk

En nog wat opinie;quote:NEW YORK (CNNMoney.com) -- Oil prices fell Tuesday, as investors believed OPEC will keep production at current levels, and as Hurricane Ike lost strength over Cuba.

U.S. crude for October delivery settled down $3.08 to $103.26 a barrel, the lowest close since April 1, when oil ended the day at $100.98 a barrel.

[..]

Slumping global energy demand has caused the price of crude to fall sharply from the record-high $147.27 a barrel, set on July 11.

[..]

As of Tuesday, 79.4% of crude oil production and 64.2% of natural gas production in the Gulf of Mexico remained shut from Gustav, according to the Department of Energy.

Hurricane destroys oil infrastructure; oil price falls

quote:Sometimes you just have to stand in awe and wonder before the all-knowing wisdom of The Market. Common sense would say: Hurricane Gustav (even considering the fact that it never achieved its advertised category 4 status before landfall) is likely to result in 40% of US Gulf of Mexico oil production being taken off-line for 30 days, with longer outages for some rigs, terminals, and refineries; therefore, given the fact that fuel supplies in the US are already tight, this is a good time to load up on oil futures.

But Noooooo. That’s not how the market works. Because the expectation of storm damage was higher, Monday’s trading was actually dominated by a sell-off.

This tells us just how important the market and price signals are in helping us prepare for the inevitable decline in world oil production. To wit: not very

[..]

Moral of the story: In the task of waking humanity up to the plight of resource depletion, the market is not very helpful, even if it occasionally does give useful warning signs. It’s a bit like the broken clock that tells perfect time twice a day.

The problem is not the occupation, but how people deal with it.

Het mooiste is dat de mens er keer op keer intrapt.quote:Op woensdag 10 september 2008 09:42 schreef Basp1 het volgende:

Toch fijn dat je met samenwerken toch een monopolie positie kan innemen en de vrije markt gewoon een dikke vinger kan geven.

The Hick from French Lick

The camera always points both ways. In expressing the subject, you also express yourself.

The camera always points both ways. In expressing the subject, you also express yourself.

Nieuw Oil Market Report van het IEA is uit. http://omrpublic.iea.org/ (Volledige versie is pas later beschikbaar)

De hoogtepunten:

De hoogtepunten:

quote:August global oil supply fell by 1.0 mb/d to 86.8 mb/d on North Sea maintenance, the BTC pipeline outage and lower OPEC supply. Non-OPEC output is revised by -180 kb/d for 2008 and by -85 kb/d for 2009, with hurricane outages impeding 2H08 supply. Non-OPEC growth including OPEC NGL is now 580 kb/d in 2008 and 1.56 mb/d in 2009.

OPEC crude supply in August fell by 195 kb/d to 32.5 mb/d on field and pipeline outages in Iraq, Angola, Libya and Nigeria, while effective spare capacity rose from 1.5 mb/d to 1.9 mb/d. The ‘call’ on OPEC is revised up to 32.2 mb/d for 3Q08 and 31.7 mb/d for 4Q08. This report went to press ahead of the OPEC 9 September meeting in Vienna.

Hurricane activity in the US Gulf of Mexico results in a 1.4 mb/d downward revision to US refinery crude throughput in September, to an average of 13.9 mb/d. Global September crude runs could decline by 1.3 mb/d from August. OECD crude runs are forecast to average 37.4 mb/d in September, their lowest level since October 2002.

OECD stocks rose by 47 mb in July to 2,646 mb. A large, unseasonal crude build from a revised June base and weaker demand leave end-July OECD cover at 54.5 days. Higher OECD end-June stocks now imply a 380 kb/d OECD stockbuild in 2Q08 versus last month’s estimate of flat second-quarter stocks, and a seasonal 2Q average build of 0.9 mb/d.

Forecast global oil demand has been lowered for both 2008 and 2009, following weaker deliveries in the OECD. World demand averages 86.8 mb/d in 2008 (+0.8% or +0.7 mb/d versus 2007 and 100 kb/d lower than previously estimated) and 87.6 mb/d in 2009 (+1.0% or +0.9 mb/d year-on-year and 140 kb/d lower than in our last report).

Benchmark crude futures continued their downward slide in August, approaching $100/bbl in early September, as fundamentals eased. Weaker OECD demand and higher stocks dominated sentiment, while markets have so far shrugged off Hurricanes Gustav and Ike, though the latter could yet defer post-Gustav supply recovery.

The problem is not the occupation, but how people deal with it.

Als het zou functioneren ja.... maar de OPEC is eigenlijk al vanaf halverwege de jaren 70 een Saoedische 'lame duck' die niet veel meer kan doen als 'achter' de olieprijs-ontwikkelingen aanlopen en te pogen wat 'correcties' aan overtollige marktprijs-fluctuaties door te voeren, veelal succesloos.quote:Op woensdag 10 september 2008 09:42 schreef Basp1 het volgende:

[..]

Toch fijn dat je met samenwerken toch een monopolie positie kan innemen en de vrije markt gewoon een dikke vinger kan geven.

De olieprijs heeft eerder steeds minder te doen met 'aanbod', maar is vooral 'vraag-gedreven' ... op dit moment zijn vooruitzichten over economisch ontwikklingen en toekomstige vraag naar olie (-verwachtingen) de prijsdrijvers .... de 'aanbod-kant' lijkt behoorlijk irrelevant t zijn voor prijs-ontwikkeling (daarom hebben die 'stormen' weinig invloed, de reserve's zijn genoeg op peil)

"Whatever you feel like: Life’s not one color, nor are you my only reader" - Ausonius, Epigrammata 25

Ze verdien wel nu helemaal goudgeld de olie maatschappijen.

Toen de olieprijs steeg ging de prijs aan de pomp aardig snel mee omhoog.

Nu is de olie prijs al een tijd gedaald en ik betaal nu nog steeds 1.49 aan de pomp.

Toen de olieprijs steeg ging de prijs aan de pomp aardig snel mee omhoog.

Nu is de olie prijs al een tijd gedaald en ik betaal nu nog steeds 1.49 aan de pomp.

............................

Aangezien er bar weinig informatie over oliegebruik via onze eigen overheid te verkrijgen is, hier een kleine inventarisatie. IEA staat voor International Energy Agency, EIA voor Energy Information Administration, NAM voor Nederlandse Aardolie Maatschappij. Aanvullingen zijn meer dan welkom.

Nederland & Aardolie

"In 2004 haalde Nederland 39% van al haar energie uit olie"

-IEA

Consumptie (EIA)

2007: 987.750 bpd

2006: 1.010.904 bpd

2005: 1.021.384 bpd

2004: 947.866 bpd

Productie

Ruwe Olie Productie: 39.900 bpd (2007, EIA)

Totale Olie Productie: 88.950 bpd (2007, EIA)

Olie-import: 898.800 bpd (2007, EIA)

Olie-Import Jan - Mei 2008 (EIA)

(miljoen vaten)

1.033 0.912 1.225 0.818 1.005

Waarvan van de OPEC

0.774 0.391 0.668 0.554 0.640

Waarvan uit Irak

0.065 0.021 0.033 0.000 0.055

(In miljoenen vaten)

Jun 2007 115,9

Sep 2007 122,9

Dec 2007 116,6

Mrt 2008 126,5

Raffinaderijen

Capaciteit

10.000 bpd Smid + Hollander Raffinaderij Amsterdam

80.000 bpd Kuwait Petroleum Europoort Rotterdam

400.000 bpd Netherlands Refining Co. (BP) Europoort

195.000 bpd ExxonMobil Refining + Supply Co. Botlek

416.000 bpd Shell Pernis Refinery

160.000 bpd Total Refinery Netherlands Vlissingen

Raffinaderij-gebruik (IEA)

Jun 2008 960.000 bpd (79%)

http://tonto.eia.doe.gov/country/country_energy_data.cfm?fips=NL

http://en.wikipedia.org/w(...)ries#The_Netherlands

http://omrpublic.iea.org/currentissues/full.pdf

http://www.iea.org/textbase/nppdf/free/2006/SR_Netherlands.pdf

http://www.eia.doe.gov/emeu/ipsr/t314.xls

http://www.eia.doe.gov/ipm/imports.html

Nederland & Aardolie

"In 2004 haalde Nederland 39% van al haar energie uit olie"

-IEA

Consumptie (EIA)

2007: 987.750 bpd

2006: 1.010.904 bpd

2005: 1.021.384 bpd

2004: 947.866 bpd

Productie

Ruwe Olie Productie: 39.900 bpd (2007, EIA)

Totale Olie Productie: 88.950 bpd (2007, EIA)

quote:Dankzij de hoge olieprijs en met nieuwe technieken, wordt ons Drentse Schoonebeek weer een rendabele oliewinplaats. Het veld sloot in 1996, maar wordt opnieuw in gebruik genomen. De verwachting is dat er de komende 25 jaar nog tot zo'n 120 miljoen vaten aan de bodem ontfutseld kunnen worden.

[..]

Er zitten een miljard vaten in de grond waarvan er tot 1996 250 miljoen naar boven zijn gehaald. Met nieuwe efficiŽnte en schone technieken kan de nogal taaie en stroperige donkere smurrie er weer uitgepompt worden.

Bron

Importquote:Waar zit de olie in Nederland? De meeste olie zit in Zuidoost-Drenthe. Dit veld staat te boek als het Schoonebeek-olieveld. Plaatsen als Schoonebeek en Coevorden zijn bekend geworden door de oliewinning en in vroegere tijden stonden daar honderden jaknikkers. In 2007 heeft de NAM besloten opnieuw olie te gaan winnen in het Schoonebeek-veld. Naar verwachting zal in 2010 de nieuwe oliewinning een feit zijn.

Daarnaast wordt op dit moment nog olie gewonnen in de omgeving van Rotterdam en op de Noordzee.

[..]

Offshore olie wordt elke 14 dagen naar de raffinaderij in Pernis gebracht. Olie uit de omgeving Rotterdam gaat via een pijpleiding naar Pernis. Olie uit Schoonebeek gaat via een pijpleiding naar de raffinaderij in Lingen (Duitsland).

Bron: NAM

Olie-import: 898.800 bpd (2007, EIA)

Olie-Import Jan - Mei 2008 (EIA)

(miljoen vaten)

1.033 0.912 1.225 0.818 1.005

Waarvan van de OPEC

0.774 0.391 0.668 0.554 0.640

Waarvan uit Irak

0.065 0.021 0.033 0.000 0.055

Voorraad (IEA)quote:De grootste opslagtanks staan op de punt van de Maasvlakte en zijn van de Maasvlakte Olie Terminal (MOT). De MOT is een samenwerking tussen BP Raffinaderij, Esso Nederland, Koeweit Petroleum, Vopak Maasvlakte Terminal, Shell Nederland en Total Opslag. Alle opslagtanks van de MOT hebben een gezamenlijke capaciteit van 4.000.000 m≥.

Bron: Wikipedia

(In miljoenen vaten)

Jun 2007 115,9

Sep 2007 122,9

Dec 2007 116,6

Mrt 2008 126,5

Raffinaderijen

Capaciteit

10.000 bpd Smid + Hollander Raffinaderij Amsterdam

80.000 bpd Kuwait Petroleum Europoort Rotterdam

400.000 bpd Netherlands Refining Co. (BP) Europoort

195.000 bpd ExxonMobil Refining + Supply Co. Botlek

416.000 bpd Shell Pernis Refinery

160.000 bpd Total Refinery Netherlands Vlissingen

Raffinaderij-gebruik (IEA)

Jun 2008 960.000 bpd (79%)

Bronnenquote:Waarvoor wordt olie gebruikt? Meer dan 86% van de totale aardolieconsumptie in Nederland wordt besteed aan brandstof voor industrie, transport en verwarming van gebouwen.

Bron: NAM

http://tonto.eia.doe.gov/country/country_energy_data.cfm?fips=NL

http://en.wikipedia.org/w(...)ries#The_Netherlands

http://omrpublic.iea.org/currentissues/full.pdf

http://www.iea.org/textbase/nppdf/free/2006/SR_Netherlands.pdf

http://www.eia.doe.gov/emeu/ipsr/t314.xls

http://www.eia.doe.gov/ipm/imports.html

The problem is not the occupation, but how people deal with it.

Dat is oud nieuws, auto verkopen of op LPG gaan rijden.quote:Op woensdag 10 september 2008 14:28 schreef sander89 het volgende:

Ze verdien wel nu helemaal goudgeld de olie maatschappijen.

Toen de olieprijs steeg ging de prijs aan de pomp aardig snel mee omhoog.

Nu is de olie prijs al een tijd gedaald en ik betaal nu nog steeds 1.49 aan de pomp.

*****Kraak........

Vat olie nu $101.

Hurricane Ike hits heart of U.S. oil sector

Benzinevoorraden VS zitten aan de onderkant, niet het beste moment nu Gustav & Ike wat raffinaderijen hebben stilgelegd rondom de Golf. Meer info bij The Oil Drum. Olieprijzen gaan hierdoor niet omhoog aangezien er minder ruwe olie wordt gekocht door de raffinaderijen die stil liggen. Benzinetekorten in de VS zijn echter al een feit.

North Carolina: Gas Woes Continue From Hurricane Ike

Michigan: Ike causes gas hikes, panic at pump

Texas: Gas stations run short amid rush to fill up

Tennessee: EPA boosts gas supply in Southeast; Knoxville running low

Missouri: Local Motorists Rush to Pumps Ahead of Ike

Georgia: Gas prices on the way back up, especially in Albany

Tot zover het land van de free en home of the brave.

Alitalia 'running out of fuel' Lekker stoer doen tegenover het Venezuelaanse volk en dan toch maar olie verkopen aan zijn 'aartsvijand' omdat ze anders gewoon geen geld meer hebben.

Lekker stoer doen tegenover het Venezuelaanse volk en dan toch maar olie verkopen aan zijn 'aartsvijand' omdat ze anders gewoon geen geld meer hebben.

The Simple Solutions

Brazil plans to build 50 more nuclear power plants

Oil shale development seems always just over horizo

Hurricane Ike hits heart of U.S. oil sector

Benzinevoorraden VS zitten aan de onderkant, niet het beste moment nu Gustav & Ike wat raffinaderijen hebben stilgelegd rondom de Golf. Meer info bij The Oil Drum. Olieprijzen gaan hierdoor niet omhoog aangezien er minder ruwe olie wordt gekocht door de raffinaderijen die stil liggen. Benzinetekorten in de VS zijn echter al een feit.

North Carolina: Gas Woes Continue From Hurricane Ike

Michigan: Ike causes gas hikes, panic at pump

Texas: Gas stations run short amid rush to fill up

Tennessee: EPA boosts gas supply in Southeast; Knoxville running low

Missouri: Local Motorists Rush to Pumps Ahead of Ike

Georgia: Gas prices on the way back up, especially in Albany

Tot zover het land van de free en home of the brave.

Alitalia 'running out of fuel'

Venezuela seeks to lower tone in US diplomatic spatquote:Italy's national airline, Alitalia, may have to cancel some flights because of a lack of funds to buy fuel, a top official has warned.

[..]

Prime Minister Silvio Berlusconi blamed "political" motives for the failure.

Wat een schreeuwlelijk is het ook.quote:CARACAS, Sept 13 (Reuters) - Venezuelan President Hugo Chavez sought to lower the tone of a diplomatic spat with the United States, saying he doesn't plan to take more steps against his country's biggest oil customer.

[..]

The Simple Solutions

En zo is het maar net. Er is genoeg olie. Nieuwe technologie 'komt wel langs'. Zuiniger zijn is voor idioten. Slimme gozer, die Ron Ewart.quote:By Ron Ewart

[..]

How is it that only politicians can take the laws of physics, economics and the principles of freedom and liberty and screw them up so badly?

[..]

The simple solution ......... We have more than enough oil on our own shores within our economic and environmentally sensitive grasp to meet our daily needs and be free of foreign blackmail. Drill for it now and put it in our cars as rapidly as we can. Build more refineries to process that oil. Cut gasoline grades down to about five, no more. Build nuclear and natural gas fired power plants. Convert coal to oil. Stop subsidies for ethanol and other uneconomic idiotic solutions and let them die a rapid death before these boon doggles drive our taxes up dramatically and drive our food prices out of reach of the average family, where we end up going hungry so a radical environmentalist or a government employee can feel good about him or herself for “saving the planet”. And stop this crazy idea of conserving energy. We don’t need to conserve, we have all the energy we need, if we will just go get it. We need to expand our opportunities and horizons, not limit them. Limits are for losers and whiners. Of course we need to continue working on economic energy solutions to replace crude oil. And in spite of what the so-called experts tell you, we are no where near “peak” oil. But new, economic technology will come along if we just let the power of our industry and capitalism operate efficiently and without impediments and constant second-guessing from an out-of-control, heavy-handed, stupid government that screws up everything it touches.

Brazil plans to build 50 more nuclear power plants

Russia tries to raise oil productionquote:RIO DE JANEIRO, Sept. 12 (Xinhua) -- Mines and Energy Minister Edison Lobao announced Friday Brazil plans to build 50 to 60 nuclear power plants in half a century, with each having capacity of 1,000 megawatts.

"The general idea is to build one plant per year," he said during a visit to the construction site of Brazil's third nuclear power plant, Angra 3.

'oil-fueled economic boom'. Dat is hetzelfde als de high van cocaÔne, het is even leuk, maar nadien ben je er slechter aan toe & verslaafd.quote:MOSCOW (AP) — Home to abundant oil reserves, Russia rarely worried about where the next barrel would come from — until now.

With analysts expecting production to fall this year for the first time in a decade, Russian companies are pushing to find new oil in remote regions such as the Arctic Shelf and East Siberia — but their efforts are hampered by crippling taxes that give the government much of the recent gains from high oil prices.

[..]

The prospering energy industry in Russia has been crucial to the career of Prime Minister Vladimir Putin, who as president oversaw an eight-year, oil-fueled economic boom which improved the lives of many ordinary Russians and helped restore national self-confidence.

Oil shale development seems always just over horizo

Nuclear output could as much as double by 2030-IAEAquote:[..]

A former government petroleum expert offered a concise explanation: The oil companies don’t really want it.

Energy companies “are not excessively interested in bringing in a new field so long as, by gradually increasing the price, they can stimulate production in the older regions,” Dr. David T. Day said.

And even though gasoline prices have gotten prohibitively high “for all but the rich” — according to the newspaper that carried Day’s remarks — the oil companies are only interested in maintaining their own profit margins, which they are doing just fine the way things are, Day said. He added, “It’s not surprising, then, that the oil companies hesitate to bring in a new and practicably inexhaustible supply of crude petroleum from oil shales.”

Oh, by the way, I should mention here that Dr. Day made these remarks nearly 90 years ago.

[..]

As I have written in countless editorials, the primary obstacle blocking commercial oil shale development is technological, not political maneuvering or corporate conspiring. The oil companies have not yet demonstrated they can successfully recover fuel from oil shale on a large scale in a way that is economically feasible. That was true in 1920 and it’s true today.

I don’t know whether those technological impediments will ever be overcome. Certainly, a few companies are working hard, attempting to do just that. Shell, in particular, has demonstrated it can successfully recover the oil from shale — at what the company says is a net energy gain — on a small scale. But transferring its very complicated technology into the scale necessary for commercial production remains uncertain.

Maar Nederland niet hoor.quote:VIENNA, Sept 11 (Reuters) - Nuclear power production could as much as double by 2030 as countries seek relief from rising fossil fuel costs and a remedy against global warming, the International Atomic Energy Agency said on Thursday.

The problem is not the occupation, but how people deal with it.

Jep, dat is wat een globale recessie doet...

The problem is not the occupation, but how people deal with it.

Die zal echt niet dalen hoor. Die sprookjes over het feit dat benzineprijs aan de olieprijs gekoppeld is hoef je per definitie niet te geloven.quote:

Zeker niets gelezen over vele gesloten rafinaderijen door Ike?quote:Op maandag 15 september 2008 12:06 schreef Bulletdodger het volgende:

nu de benzineprijs nog

Olie <> benzine.

For great justice!

Wij krijgen geen benzine van die kant, dat ze daar tekorten hebben zegt al dat wij er geen last van hoeven te hebben.quote:Op maandag 15 september 2008 12:14 schreef Q. het volgende:

[..]

Zeker niets gelezen over vele gesloten rafinaderijen door Ike?

Olie <> benzine.

censuur :O

Tenzij Europa benzine gaat leveren aan de VS, wat in 2005 ook gebeurde.quote:Op maandag 15 september 2008 12:24 schreef RemcoDelft het volgende:

[..]

Wij krijgen geen benzine van die kant, dat ze daar tekorten hebben zegt al dat wij er geen last van hoeven te hebben.

En voor iedereen die maar wat lult dat de benzineprijs niet aan de olieprijs gekoppeld is: Bron?

The problem is not the occupation, but how people deal with it.

En sowieso heeft men in de VS al langer een probleem met de rafinage capaciteit. Aangezien de olie die op dit moment het meest leverbaar is geen texas sweet crude kwaliteit meer is en men veel meer moet ontzwavelen maar daarop de rafinaderijen nog steeds niet aangepast heeft.

3 jaar geleden tankte je aan de pomp voor 1.19 een liter benzine, met een olieprijs van 75 dollar.quote:Op maandag 15 september 2008 12:31 schreef waht het volgende:

[..]

Tenzij Europa benzine gaat leveren aan de VS, wat in 2005 ook gebeurde.

En voor iedereen die maar wat lult dat de benzineprijs niet aan de olieprijs gekoppeld is: Bron?

Nu betaal je 1.62 aan de pomp, met een olieprijs van 98 dollar....

De olieprijs is met een kwart gestegen, de benzineprijs met 40%.

[ Bericht 3% gewijzigd door #ANONIEM op 15-09-2008 12:54:59 ]

Oke, daar gaan we.quote:Op maandag 15 september 2008 12:49 schreef Scorpie het volgende:

[..]

3 jaar geleden tankte je aan de pomp voor 1.19 een liter benzine, met een olieprijs van 75 dollar.

Nu betaal je 1.62 aan de pomp, met een olieprijs van 98 dollar....

De olieprijs is met een kwart gestegen, de benzineprijs met 40%.

3 jaar geleden? 15 september 2005?

Eerder dus $57 per vat.quote:2005-Sep 09/02 60.75 09/09 59.18 09/16 56.93 09/23 58.20

http://tonto.eia.doe.gov/dnav/pet/hist/wtotworldw.htm

http://asp.unitedconsumers.com/graph_landadvies.asp (doet het alleen met Internet Explorer)

Eťn ding is duidelijk, de benzineprijs lag niet op 1.19, een stuk hoger en minstens op 1.35.

Afgezien van dit duurt het, zoals ik al eerder zei, ongeveer een maand voordat het doorberekent wordt. Prijzen van nu horen bij de olieprijzen van een maand geleden die veel hoger lagen. En zoals ook al eerder gezegd, het loopt niet 1 op 1.

The problem is not the occupation, but how people deal with it.

http://www.upstreamonline.com/market_data/?id=markets_oil

Urals, Oman 1M en Forties onder de $90.

Lijst van verschillende olie-types

Urals, Oman 1M en Forties onder de $90.

Lijst van verschillende olie-types

The problem is not the occupation, but how people deal with it.

De Brent olie staat al onder de 90 dollar.quote:Op maandag 15 september 2008 12:24 schreef RemcoDelft het volgende:

[..]

Wij krijgen geen benzine van die kant, dat ze daar tekorten hebben zegt al dat wij er geen last van hoeven te hebben.

Olie rond $92. Had ik persoonlijk nooit kunnen voorspellen. Anders was ik namelijk rijk geweest en zat ik niet op FOK!.

Former oil exec: Gas rationing needed

The Oil Drum: Damage Caused by Hurricane Ike

All-electric vehicles no magic bullet: scientist

Nigerian militants launch new attacks on oil sector

Weak oil and debt markets may bedevil oil sands plans

The price of oil has nowhere to go but up

Leestip:

The net energy cliff

Former oil exec: Gas rationing needed

Tsja, verkiezingen hŤ?quote:John Hofmeister, the former president of Shell Oil Co. and one of the most influential voices in the oil industry, called for short-term gasoline rationing by introducing odd-even purchases based on an automobile's license plate and by limiting the amount of gasoline drivers can purchase.

The United States will be in "a world of hurt" for the next four to six weeks as the oil industry recovers from the damage from Hurricanes Gustav and Ike, said Mr. Hofmeister, who recently founded a new company, Citizens for Affordable Energy. The areas where rationing will be needed include the Southeast and extend northward toward Denver, the upper Midwest and Washington, D.C., Mr. Hofmeister said in a newsmaker interview Monday morning with editors and reporters of The Washington Times.

[..]

"America is suffering a lot more than is being reported," said Mr. Hofmeister, who is also chairman of the National Urban League. The economic slowdown may not be affecting the well-to-do, but it is "really nailing middle- and low-income people."

The Oil Drum: Damage Caused by Hurricane Ike

Misschien horen deze niet in dit topic, maar toch, Crystal Beach;quote:

According to today's DOE report, 3.6 million barrels of refinery capacity is shut in, and 2.5 million barrels is operating with reduced runs. In my refinery article, I used an estimate of one-third of production from reduced runs being off line. With this approach, 4.4 million barrels of refinery production is off-line, which is about 22% of oil products use. The corresponding calculation from yesterday's report would indicate that 4.5 million barrels were offline then, so we are making slight progress. It would be difficult to get along without 22% of oil products for long, however.

[..]

The report indicates that 1.3 million barrels of crude oil production is off-line. The US produced a total of about 5.1 million barrels of crude oil a day, including all of the United States. The amount currently off-line amounts to about 25% of US production.

All-electric vehicles no magic bullet: scientist

Credit crisis hurting clean energy sector: bankersquote:ARGONNE, Illinois (Reuters) - A future of all-electric cars coasting along streets and highways may be illusory, given that their range may be cut in half by aggressive drivers speeding along with the air conditioning blasting, U.S. scientists said on Monday.

That may not be a bad thing, as it will persuade consumers to choose the best blend of electric- and gas-powered hybrid vehicle to suit the type of driving they do.

House to vote on offshore drilling Tuesdayquote:LONDON (Reuters) - The renewable energy sector will see a 21 billion euro ($29.43 billion) shortfall in debt finance by 2020, following the credit crisis and a brake on lending, a senior banker said on Monday.

Investors at a renewable energy finance conference in London tried to digest the implications of a banking hiatus following Lehman Brothers' filing for bankruptcy and Bank of America's acquisition of Merrill Lynch.

[..]

"The credit crunch will have a major impact on the renewable energy sector," Cuppen said. "I think we haven't had the worst yet."

[..]

However, energy infrastructure projects are hurting because the banks, faced with the threat of more loan defaults, are limiting lending.

Nigerian militants launch new attacks on oil sector

Weak oil and debt markets may bedevil oil sands plans

The price of oil has nowhere to go but up

Leestip:

The net energy cliff

quote:Charles Hall, the father of the energy return on investment (EROI) concept, once told me that our current society would probably not be able to function if the EROI for the entire society slipped below five.

What does that mean?

The problem is not the occupation, but how people deal with it.

Ik had het wel gedacht en loop hier al langer te roepen dat commoties een bubble zijnquote:Op dinsdag 16 september 2008 10:08 schreef waht het volgende:

Olie rond $92. Had ik persoonlijk nooit kunnen voorspellen. Anders was ik namelijk rijk geweest en zat ik niet op FOK!.

Maar heb ik er geld op gezet? Natuurlijk niet. Markten voorspellen is casinowerk. Met de aandelenmarkten riep ik ook in 1998 al dat het een bubble was. Maar die bubble liep nog 2 jaar door en ging nog veel hoger dan ik ooit had gedacht. Gelukkig niet short gegaan in 1998 (wel het meeste verkocht).

"If you want to make God laugh, tell him about your plans"

Mijn reisverslagen

Mijn reisverslagen

Straks wordt energie gewoon weer bereikbaar voor het plebs

Ik vond het wel mooi eigenlijk, benzine van § 1,65

Op donderdag 28 augustus 2008 14:34 schreef Breathtaking het volgende:

:9~

:9~

Brent Noordzee-olie zit daar al een tijdjequote:Op dinsdag 16 september 2008 21:18 schreef Q. het volgende:

Bizar! Zou het nog onder de 90 dollar komen? Vast wel.

"Alternatieven? Die hebben we toch heul niet nodig met zulke goedkope olie?"quote:Op dinsdag 16 september 2008 22:27 schreef sungaMsunitraM het volgende:

Straks wordt energie gewoon weer bereikbaar voor het plebs

Ik vond het wel mooi eigenlijk, benzine van § 1,65

Ach, met al die failliete financials is er toch niemand meer die leningen af geeft voor duurzame energie. Arme wij.

For great justice!

Vanmiddag de brandstofvoorraden van de VS.

Drivers and Gas Stations On Empty

Google News: Gas Shortage

Hurricane Ike Damages Several US Offshore Platforms

Opnieuw olie-installatie verwoest in Nigeria

UK government responds to oil depletion e-petition

Were We Wrong To Fret About Peak Oil?

En het gevolg van buiten werking zijnde raffinaderijen en pijpleidingen;quote:On average, industry analysts surveyed by Platts expect the Wednesday report to show that crude supplies fell by 3.7 million barrels for the week ended Sept. 12, distillates fell by 1.7 million and motor gasoline inventories fell by 3.6 million barrels.

"A combination of lower imports as the Louisiana Offshore Oil Platform and the Houston Ship Channel closed ahead of the arrival of Hurricane Ike, as well as oil production in the Gulf of Mexico that remained shut-in after Hurricane Gustav, will result in another week of sharp stock declines," said Linda Rafield, Platts senior oil analyst, in a note to clients.

Drivers and Gas Stations On Empty

Google News: Gas Shortage

Oil price dives againquote:The reason that GA, SC, NC, TN are seeing more shortages than other parts of the country is that they are total dependant on the pipelines to supply them. They have no other source of supply than the Gulf refineries. This makes those area particularly susceptible to Gulf outages.

According to the EIA the US has about 20 days of finished product inventory. About one-half of that inventory is stuck in a pipe somewhere between the source (refinery, import point) and the storage tanks at the end of the pipelines. The US has at most about 10 days of useable stock at any point in time.

Hurricane Ike Damages Several US Offshore Platforms

Opnieuw olie-installatie verwoest in Nigeria

UK government responds to oil depletion e-petition

Het is (al lang) geen discussie meer ůf er een piek in olieproductie is/komt. Het is nu wanneer.quote:The Government’s assessment is that the world’s oil resources are sufficient to prevent global total oil production peaking in the foreseeable future. This is consistent with the assessment made by the International Energy Agency (IEA) in its recent 2007 World Energy Outlook (WEO), which concludes that proven reserves are already larger than the cumulative production needed to meet rising demand until at least 2030.

Were We Wrong To Fret About Peak Oil?

Offshore drilling, waar?quote:Remember when $200-per-barrel oil looked inevitable? Or, at the very least, a $100-per-barrel plateau looked certain? Plenty of oil analysts thought that was just over the horizon (yes, I was also guilty of this). But now crude futures are hovering down around $90, despite the succession of brutal hurricanes in the Gulf of Mexico—mainly due to fears that the crisis on Wall Street will knock more wind out of the U.S. economy and further dampen demand. So does that mean all the frantic concern about "peak oil" and all the apocalyptic blather about the end of mass air travel and so on and so forth was all totally baseless and wrong?

Well, I'm not sure about that. Production figures and forecasts still suggest that oil production really may peak in the next few years. But it's worth trying to clarify what peak oil would actually entail. Here's Richard Heinberg of the Post Carbon Institute: "Sometime around 2010 (give or take two or three years), growing decline rates in oil production from existing oilfields will overwhelm new production streams coming online. The price of oil will rise dramatically. However, when it does it will cripple the trucking industry, the airline industry, tourism, agriculture—essentially, the whole economy. A serious recession will ensue, which will reduce demand for oil (among other things). Oil’s price will temporarily drop in response. Then, as declines in oil production worsen, the price will resume its upward march—but again in a sawtooth or whipsaw fashion."

In other words, if global production is in fact peaking, we may be in not so much for an inexorable march upward in the price of oil and a permanent $150-per-barrel plateau, but rather lots and lots of volatility—which would prove just as damaging in the long run. (What good is cheap oil if we have to suffer through a recession to get it?) Now, if Heinberg's right, then it's a good time to start reducing our vulnerability to oil shocks, which in the long term means getting off the black gooey stuff for good. In the short term, that means—among other things—upping the energy intensity of the economy (especially in the transport sector), which would minimize the damage inflicted by rapid price fluctuations. The fact that prices have rocketed back down rather quickly is no reason to get complacent. On the other hand, if we're in a world of wildly volatile—rather than permanently high—oil prices, that also makes it much harder for alternative energy sources to get a foothold in the market without smarter policies from on high.

The problem is not the occupation, but how people deal with it.

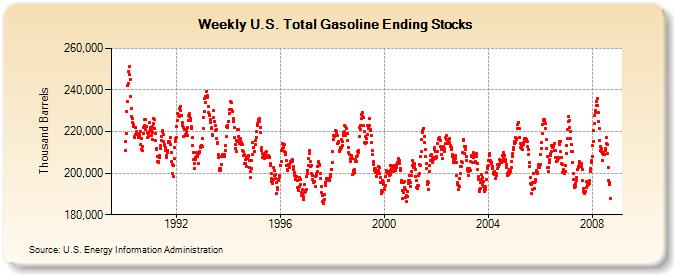

Brandstofvoorraden

In miljoenen

Ruwe Olie: 291,7 (-6,3 tov vorige week)

Benzine: 184,6 (-3,3 tov vorige week)

Olie import: 9,199 (-10,5 % tov vorig jaar)

Productie: 4,519 (-7,8 % tov vorig jaar)

Totaal aanbod: 19,880 (-4,4% tov vorig jaar)

Naar het blijkt is de benzinevoorraad het laagste sinds 1990 toen de EIA begon dit vast te leggen.

In miljoenen

Ruwe Olie: 291,7 (-6,3 tov vorige week)

Benzine: 184,6 (-3,3 tov vorige week)

Olie import: 9,199 (-10,5 % tov vorig jaar)

Productie: 4,519 (-7,8 % tov vorig jaar)

Totaal aanbod: 19,880 (-4,4% tov vorig jaar)

Naar het blijkt is de benzinevoorraad het laagste sinds 1990 toen de EIA begon dit vast te leggen.

The problem is not the occupation, but how people deal with it.

Speculaties? Voorraad nu verkopen en aanvullen als de olie nog goedkoper is?quote:Op woensdag 17 september 2008 17:42 schreef waht het volgende:

Naar het blijkt is de benzinevoorraad het laagste sinds 1990 toen de EIA begon dit vast te leggen.

censuur :O

Heeft te maken met de seizoensgebonden hogere vraag naar benzine, 'driving season'. Maar die is eigenlijk op labor day (1 sept) al afgelopen. Daarna hadden we Gustav en nu Ike. Die hebben voor een groot gedeelte de raffinage-capaciteit rond de Golf stilgelegd. Verder heeft de VS geen strategische opslag van benzine (wel van ruwe olie) dus moeten ze het doen met de commerciŽle voorraden.quote:Op woensdag 17 september 2008 19:51 schreef RemcoDelft het volgende:

[..]

Speculaties? Voorraad nu verkopen en aanvullen als de olie nog goedkoper is?

Benzineprijzen zitten tot nu toe ongeveer 10-30 cent onder de records van juni/juli.

http://www.eia.doe.gov/oi(...)p/mogas_history.html

En de prijs van RBOB gasoline futures blijft verder vallen.

Hier de spot price van benzine.

The problem is not the occupation, but how people deal with it.

Dat klopt niet hoorquote:Op vrijdag 19 september 2008 20:24 schreef waht het volgende:

[ afbeelding ]

Lekker stabiele prijs tegenwoordig.

Ik had al zo'n vermoeden. Maar dan nog, een stijging van $10 in twee dagen...quote:

The problem is not the occupation, but how people deal with it.

De dollar daalt weer...quote:Op zaterdag 20 september 2008 12:12 schreef waht het volgende:

[..]

Ik had al zo'n vermoeden. Maar dan nog, een stijging van $10 in twee dagen...

censuur :O

Olie afgelopen vrijdag gesloten op $104.