WGR Werk, Geldzaken, Recht en de Beurs

Hier kun je alles kwijt over sollicitaties, werksituaties, belastingen, (handelen op) de beurs, hypotheken, beleggingen en salarissen, arbeidscontracten of geschillen met je (huis)baas. Alles over werk, geldzaken en recht dus.

Recovery in sight.quote:Mortgage-Bond Yields Jump to Highest Since Fed’s Buying Plan

June 8 (Bloomberg) -- Yields on Fannie Mae and Freddie Mac mortgage securities climbed to their highest since Nov. 24, the day before the Federal Reserve announced plans to buy the bonds to drive down interest rates on new home loans.

Yields on Washington-based Fannie Mae’s current-coupon 30- year fixed-rate mortgage bonds rose 0.12 percentage point to 5.02 percent as of 3:23 p.m. in New York, according to data compiled by Bloomberg. That’s the highest since Nov. 24 and up from 3.94 percent on May 20, Bloomberg data show.

Yields on the securities rose faster than rates on benchmark Treasuries today because the U.S. central bank hasn’t taken action in response to soaring home-financing costs, which the Fed has been influencing through debt purchases in order to stabilize the housing market, said Walt Schmidt, a mortgage-bond strategist at FTN Financial in Chicago.

“The fact that the Fed has not come in and supported the ‘national mortgage rate,’ that has gotten the market spooked,” Schmidt said in a telephone interview today.

The difference between yields on the Fannie Mae bonds and 10-year Treasuries widened 0.05 percentage point today to 1.12 percentage points, Bloomberg data show. The gap, which grew to as much as 2.38 percentage points last year, contracted to 0.70 percentage point on May 22, the lowest since 1992.

Last week, the Fed said it bought a net $25.8 billion of Fannie Mae, Freddie Mac and Ginnie Mae mortgage bonds in the week ended June 3, compared with a weekly average of $24.1 billion since the initiative began in January.

The Fed initially said on Nov. 25 that it would buy $500 billion of so-called agency mortgage securities, before announcing in March that it would expand the program to $1.25 trillion, as well as buy $300 billion of Treasuries.

The average rate on a typical 30-year mortgage jumped back to 5.29 percent in the week ended June 4, the highest since December and up from a record low of 4.78 percent in April, according to McLean, Virginia-based Freddie Mac

President Camacho

TV series: Boardwalk Empire | Burn Notice | Dexter | Game of Thrones | Impractical Jokers | Luther | Sherlock | Sons of Anarchy

TV series: Boardwalk Empire | Burn Notice | Dexter | Game of Thrones | Impractical Jokers | Luther | Sherlock | Sons of Anarchy

Exclusive Interview with Future Prediction Expert Gerald Celente

http://www.humanevents.com/article.php?id=32152

http://www.humanevents.com/article.php?id=32152

quote:In fact, as Mr. Celente sees it, the Great Depression will seem like a mild recession as what waits for us in 2011 hits with the force of a Katrina financial hurricane.

quote:"These previous bubbles were not allowed to pop -- but they didn’t destroy the infrastructure of the country. This bailout bubble will."

"But this bubble will be the last one. After the final blowout of the bailout bubble, we are concerned that the government will take the nation into war. This is a historical precedent that’s been done over and over again."

President Camacho

TV series: Boardwalk Empire | Burn Notice | Dexter | Game of Thrones | Impractical Jokers | Luther | Sherlock | Sons of Anarchy

TV series: Boardwalk Empire | Burn Notice | Dexter | Game of Thrones | Impractical Jokers | Luther | Sherlock | Sons of Anarchy

http://www.telegraph.co.u(...)der-use-of-yuan.html

Pberends, kop jij 'm de FP in?

Pberends, kop jij 'm de FP in?

quote:Top Chinese banker Guo Shuqing calls for wider use of yuan

The head of China's second-largest bank has said the United States government should start issuing bonds in yuan, rather than dollars, in the latest indication of the increasing importance of the Chinese currency.

Published: 5:38AM BST 08 Jun 2009

Guo Shuqing, the chairman of state-controlled China Construction Bank (CCB), also said he is exploring the possibility of issuing loans to trading companies in yuan, allowing Chinese and foreign companies to settle their bills in yuan rather than in dollars.

Mr Guo said the issuing of yuan bonds in Hong Kong and Shanghai would help to develop the debt markets in China and promote the yuan as a major international currency.

It was the first time the head of a major Chinese bank has called for the wider use of the yuan, although a chorus of senior government officials have already voiced their concerns about the stability of the dollar and have said the yuan should be used more widely.

"I think the US government and the World Bank can consider the issuing of renminbi bonds," he said, asking for a "mutual cooperation" between the US and China to promote Chinese financial services. He said bond issuance could be relatively small, at between 1bn and 3bn yuan (£100m to £300m).

HSBC and Standard Chartered have both said they are preparing to issue bonds denominated in yuan.

Mr Guo is a former head of China's foreign-exchange administration, which manages the country's $1.9 trillion foreign exchange reserves. He said he was confident the yuan would become a major currency in the medium-to-long term.

Two months ago, before the G20 meeting in London, Zhou Xiaochuan, the head of the People's Bank of China, the central bank, published a personal paper proposing to replace the dollar as the international reserve currency. His call came after Wen Jiabao, the Chinese premier, asked the US to guarantee the safety of China's huge pile of US debt.

In April, the Chinese government said traders in Shanghai, Shenzhen, Guangzhou, Zhuhai, Dongguan, Hong Kong, Macau, Yunan and Guangxi could start to settle their bills in yuan, rather than dollars, paving the way for the currency to become more fully convertible.

De yuan heeft wekt wel meer vertrouwenquote:Op dinsdag 9 juni 2009 00:51 schreef superworm het volgende:

http://www.telegraph.co.u(...)der-use-of-yuan.html

Pberends, kop jij 'm de FP in?

[..]

Dus eigenlijk zeggen ze dat ze de RMB willen laten floaten?

Zeg maar dag tegen die explosieve economische groei in China in dat geval

Zeg maar dag tegen die explosieve economische groei in China in dat geval

"If you want to make God laugh, tell him about your plans"

Mijn reisverslagen

Mijn reisverslagen

Nee zo moet je het volgens mij ook niet zien, het zijn net een stel blaffende honden ze roepen wel van alles maar doen zelf niet bijster veel om de RMB tot een wereld munt te willen maken. Ze blijven gewoon veel geld naar de VS verschepen om op die onnatuurlijk manier hun wisselkoers flink laag te houden.quote:Op dinsdag 9 juni 2009 10:19 schreef SeLang het volgende:

Dus eigenlijk zeggen ze dat ze de RMB willen laten floaten?

Zeg maar dag tegen die explosieve economische groei in China in dat geval

Nee, niet superboeiend...quote:Op dinsdag 9 juni 2009 00:51 schreef superworm het volgende:

http://www.telegraph.co.u(...)der-use-of-yuan.html

Pberends, kop jij 'm de FP in?

[..]

President Camacho

TV series: Boardwalk Empire | Burn Notice | Dexter | Game of Thrones | Impractical Jokers | Luther | Sherlock | Sons of Anarchy

TV series: Boardwalk Empire | Burn Notice | Dexter | Game of Thrones | Impractical Jokers | Luther | Sherlock | Sons of Anarchy

President Camacho

TV series: Boardwalk Empire | Burn Notice | Dexter | Game of Thrones | Impractical Jokers | Luther | Sherlock | Sons of Anarchy

TV series: Boardwalk Empire | Burn Notice | Dexter | Game of Thrones | Impractical Jokers | Luther | Sherlock | Sons of Anarchy

quote:1 maands Euribor-rente kruipt richting de 1%

De Euribor, de Europese interbancaire rente, is sinds een kleine maand bezig met een gestage opmars.

1 maand en 1 week

De 1 maands Euribor, de basis van veel variabele hypotheken in Nederland, is de afgelopen maand gestegen van 0,816% op 18 mei naar 0,962% vandaag. Het tarief is natuurlijk nog ontzettend laag: op 6 oktober was het tarief nog 5,20%. Begin dit jaar deed de 1 maands nog 2,5%.

De stijging van de 1 weeks rente is nog groter: van 0,696% op 18 mei naar 0,911% nu.

President Camacho

TV series: Boardwalk Empire | Burn Notice | Dexter | Game of Thrones | Impractical Jokers | Luther | Sherlock | Sons of Anarchy

TV series: Boardwalk Empire | Burn Notice | Dexter | Game of Thrones | Impractical Jokers | Luther | Sherlock | Sons of Anarchy

President Camacho

TV series: Boardwalk Empire | Burn Notice | Dexter | Game of Thrones | Impractical Jokers | Luther | Sherlock | Sons of Anarchy

TV series: Boardwalk Empire | Burn Notice | Dexter | Game of Thrones | Impractical Jokers | Luther | Sherlock | Sons of Anarchy

Hij schreeuwt een "klein beetje", maar hij heeft goede puntenquote:

---

And when the leaves fall the land looks more human

it's got me questioning the essence of my farm boy blues

hence, I never wore the fashions of the know-what-I'm-doin'

And when the leaves fall the land looks more human

it's got me questioning the essence of my farm boy blues

hence, I never wore the fashions of the know-what-I'm-doin'

Even spammen:

Lees verder op de FP: http://frontpage.fok.nl/column/9749/1/quote:Gerrit Zalm, de slechtste minister van FinanciŽn

Tot mijn grote verbazing werd Gerrit Zalm vorige week verkozen tot beste minister van FinanciŽn. Nota bene door 150 economen en financieel journalisten. Nu heb ik geen idee of andere ministers van FinanciŽn beter waren, maar dat hij zo de hemel ingeprezen werd door mensen die er verstand van zouden moeten hebben, is opmerkelijk te noemen.

Vorige week werd bij RTL Z de door mij gerespecteerde en altijd nuchtere econoom Mathijs Bouman naar zijn mening gevraagd over Zalm. Ik had verwacht dat Bouman korte metten zou maken met Zalms beleid, maar niets was minder waar.

Schijnbaar vindt iedereen Zalm goed, simpelweg omdat Gerrit een goede reputatie heeft. Nobody seems to know, nobody seems to care. De werkelijk zegt echter iets totaal anders over het beleid van de VVD'er.

President Camacho

TV series: Boardwalk Empire | Burn Notice | Dexter | Game of Thrones | Impractical Jokers | Luther | Sherlock | Sons of Anarchy

TV series: Boardwalk Empire | Burn Notice | Dexter | Game of Thrones | Impractical Jokers | Luther | Sherlock | Sons of Anarchy

When the student is ready, the teacher will appear.

When the student is truly ready, the teacher will disappear.

When the student is truly ready, the teacher will disappear.

Ik heb het audioboek.quote:Op dinsdag 9 juni 2009 23:12 schreef Aether het volgende:

Heeft iemand z'n [ link | afbeelding ] gelezen?

Het is een beetje oud nieuws allemaal (maar okee, het is ook een boek van een paar jaar geleden)

"If you want to make God laugh, tell him about your plans"

Mijn reisverslagen

Mijn reisverslagen

Heb 'm nu even helemaal afgekeken, is het niet gewoon een ordinaire reclamestunt voor die goudsite? Als het serieus is: Als je de creditcard maxt en daarvoor goud koopt en de schuld niet terugbetaalt, kunnen ze dan geen beslag op dat goud leggen?quote:Op dinsdag 9 juni 2009 22:56 schreef Zero2Nine het volgende:

[..]

Hij schreeuwt een "klein beetje", maar hij heeft goede punten

---

And when the leaves fall the land looks more human

it's got me questioning the essence of my farm boy blues

hence, I never wore the fashions of the know-what-I'm-doin'

And when the leaves fall the land looks more human

it's got me questioning the essence of my farm boy blues

hence, I never wore the fashions of the know-what-I'm-doin'

Zo saai?!quote:

Misschien 'ns aanschaffen.

quote:Get Ready for Inflation and Higher Interest Rates

The unprecedented expansion of the money supply could make the '70s look benign.

When the student is ready, the teacher will appear.

When the student is truly ready, the teacher will disappear.

When the student is truly ready, the teacher will disappear.

De Rabo probeert weer wat zieltjes te winnen:

quote:Rabobank waarschuwt voor teveel enthousiasmeDe Nederlandse economie heeft de ergste krimp achter de rug, maar de recessie is nog lang niet voorbij. De Nederlandse economie zal dit jaar niet met 4% maar met 6% krimpen. [...]

http://www.rtl.nl/(/finan(...)g_niet_voorbij_6.xml

"People that use Fiat currency as a store of value.

There is a name for it:

We call them Poor"

There is a name for it:

We call them Poor"

Zieltjes voor wat?

Ik in een aantal worden omschreven: Ondernemend | Moedig | Stout | Lief | Positief | IntuÔtief | Communicatief | Humor | Creatief | Spontaan | Open | Sociaal | Vrolijk | Organisator | Pro-actief | Meedenkend | Levensgenieter | Spiritueel

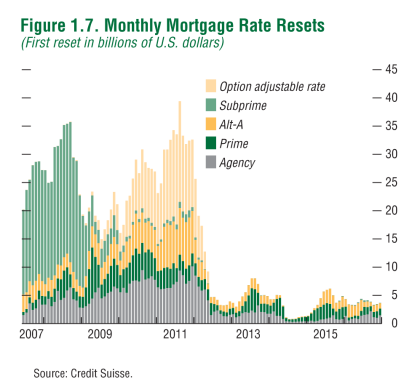

Bloemetjesbergquote:Option ARMs Threaten U.S. Housing Rebound as 2011 Resets Peak

June 11 (Bloomberg) -- Shirley Breitmaier’s mortgage payment started out at $98 when she refinanced her three-bedroom home in Galt, California, in 2007. The 73-year-old widow may see it jump to $3,500 a month in two years.

Breitmaier took out a payment-option adjustable rate mortgage, a loan popular during the housing boom for its low minimum payments before resetting at higher costs later.

About 1 million option ARMs are estimated to reset higher in the next four years, according to real estate data firm First American CoreLogic of Santa Ana, California. About three quarters of those loans will adjust next year and in 2011, with the peak coming in August 2011 when about 54,000 loans recast, the data show.

Option ARM borrowers hit with unaffordable monthly payments are another threat to the housing recovery and the economy, said Susan Wachter, a professor of real estate finance at the University of Pennsylvania’s Wharton School in Philadelphia. Owners who surrender properties to the bank rather than make higher payments for homes that have plummeted in value will further depress real estate prices and add to the inventory of properties on the market, she said.

“The option ARM recasts will drive up the foreclosure supply, undermining the recovery in the housing market,” Wachter said in an interview. “The option ARMs will be part of the reason that the path to recovery will be long and slow.”

Option ARM recasts will mean more pain for California, the state with the most foreclosures in the U.S.

$750 Billion Problem

More than $750 billion of option ARMs were originated in the U.S. between 2004 and 2008, according to data from First American and Inside Mortgage Finance of Bethesda, Maryland. California accounted for 58 percent of option ARMs, according to a report by T2 Partners LLC, citing data from Amherst Securities and Loan Performance.

Shirley Breitmaier took out a $315,000 option ARM to refinance a previous loan on her house.

Her payments started at 3/8 of 1 percent, or less than $100 a month, according to Cameron Pannabecker, the owner of Cal-Pro Mortgage and the Mortgage Modification Center in Stockton, California, who is working with Breitmaier. The loan allowed her to forgo higher payments by adding the unpaid balance to the principal. She’ll be required to start paying principal and interest to amortize the debt when the loan reaches 145 percent of the original amount borrowed.

Hoping for Help

Breitmaier, who has been in the home for 45 years and lives with her daughter, now fears she will lose the off-white stucco house that’s a hub for her family.

“I wish the government would bail us out like the banks and the car businesses,” she said. “I’d like to go from here to the grave next to my husband.”

Paul Financial LLC originated the loan and it was sold to GMAC, Pannabecker said.

“This loan is a perfect example front to back, bottom to top, of everything that has gone wrong over the last five to seven years,” Pannabecker said. “The consumer had a product pushed on them that they had no hope of understanding.”

GMAC is working with Breitmaier and will review all of her options, said Jeannine Bruin, a spokeswoman for the company. Bruin declined to be more specific, citing the firm’s customer confidentiality policy.

Inexpensive Payments

Peter Paul of Paul Financial, based in San Rafael, California, said he wasn’t familiar with Breitmaier’s loan agreement but disagreed with Pannabecker’s characterization.

“The problem is, real estate values went down,” Paul said. Paul said he’s winding down the company and hasn’t made any loans since the fall of 2007.

Option ARMs typically recast after five years and the lower payments can end before that time if the loan balance increases to 110 percent or 125 percent of the original mortgage, according to a Federal Reserve brochure on its Web site.

These home loans were primarily marketed to people with good credit scores, said Dirk van Dijk, director of research at Zacks Investment Research in Chicago. They were also sold to the elderly and immigrants who were lured by inexpensive payments, said Maeve Elise Brown, executive director of Housing and Economic Rights Advocates in Oakland, California.

Refinancing is impossible in many states given the nationwide drop in prices. In California, the median existing single-family home price dropped 37 percent in April to $256,700 from a year earlier, according to the state Association of Realtors.

Late Payments Soar

“Once you start amortizing that loan, the payment is going to shoot up,” said David Watts, a London-based strategist with research firm CreditSights.

The delinquency rate for payment-option ARMs originated in 2006 and bundled into securities is soaring, according to a May 5 report from Deutsche Bank AG. Over the past year, payments 60 days late or more on option ARMs originated in 2006 have almost doubled to 42.44 percent from 23.26 percent, Deutsche Bank said. For 2007 loans, the rate has climbed from 10.1 percent to 35.25 percent.

“We’re already seeing much higher levels of delinquencies of these option ARM loans even before you reach the point of the recast,” said Paul Leonard, the California director of the non- profit Center for Responsible Lending.

The threat of soaring payments has counselors at Housing and Economic Rights Advocates busy.

“There’s a level of hopelessness to the phone calls now,” said Brown.

We pakken 'm er weer bij:

President Camacho

TV series: Boardwalk Empire | Burn Notice | Dexter | Game of Thrones | Impractical Jokers | Luther | Sherlock | Sons of Anarchy

TV series: Boardwalk Empire | Burn Notice | Dexter | Game of Thrones | Impractical Jokers | Luther | Sherlock | Sons of Anarchy