WGR Werk, Geldzaken, Recht en de Beurs

Hier kun je alles kwijt over sollicitaties, werksituaties, belastingen, (handelen op) de beurs, hypotheken, beleggingen en salarissen, arbeidscontracten of geschillen met je (huis)baas. Alles over werk, geldzaken en recht dus.

Nou nou poeh hee... Wat een angstzaaierij... en waarop baseren we dat nu weer? Op die geweldige signature??quote:Op maandag 16 februari 2009 06:53 schreef vastgoedzeepbel het volgende:

[..]

De Rabo is helemaal niets beter....

Stellingen innemen en boude uitspraken doen is prima de bima, maar... onderbouw wel even waar je dat vandaan hebt (en nee, niet uit die geweldige weblog met gejatte stukken tekst)

Als alles op jou afkomt, zit jij op de verkeerde baan.

Wat is er dan zo goed aan de Rabobank?quote:Op maandag 16 februari 2009 09:40 schreef Goverman het volgende:

[..]

Nou nou poeh hee... Wat een angstzaaierij... en waarop baseren we dat nu weer? Op die geweldige signature??

Stellingen innemen en boude uitspraken doen is prima de bima, maar... onderbouw wel even waar je dat vandaan hebt (en nee, niet uit die geweldige weblog met gejatte stukken tekst)

-dat ze als één van de eerste binnen Europa zijn begonnen met securitisatie?

-de OpMaat Hypotheek? (woekerpolis) of de Generatie Hypotheek ?

-dat ze ook miljarden hebben moeten afschrijven op CDO's?

- of omdat ze de grootste zeepbel ter wereld (de Nederlandse huizenmarkt) voor een groot deel gefinancierd hebben?

Banken zijn allemaal hetzelfde.

Nederlanders hebben de hoogste hypotheekschuld ter wereld en de Rabobank betaalbaaheidsindex staat op het laagste niveau sinds 1970. Wanneer knapt deze zeepbel?

huizenmarkt-zeepbel.nl

verwachtingen woningmarkt experts

huizenmarkt-zeepbel.nl

verwachtingen woningmarkt experts

Wat er zo goed is aan de Rabobank? Dat ze zo'n beetje de enige bank zijn die niet bij Wouter heeft hoeven aankloppen.

En verder, de statements zijn hier ook weer niets nieuws onder de zon. Ofwel: de Rabobank kan - totdat anders blijkt - zijn hoofd nog boven water houden.

Geef nou eens aan wat er precies mis is, in plaats van wedervragen te stellen. Niet alle gebruikte technieken en innovaties van de laatste jaren zijn slecht en niet alle producten zijn waardeloos. Ik hoor niets over de flinke positie die de Rabobank heeft op de agrarische sector (wellicht niet een spannend, maar wel een constant en degelijk rendement). Ook over de coöperatieve structuur hoor ik niets, afgezien van jouw statement dat alle banken hetzelfde zijn (wat dús niet zo is...).

Maar ja, wedervragen stellen, dossiers koppelen en metaforen gebruiken is een gebruikelijke tacktiek voor mensen die menen gelijk te hebben zonder het zelf te kunnen onderbouwen. (vgl. politici, profeten en profvoetbaltrainers)

En verder, de statements zijn hier ook weer niets nieuws onder de zon. Ofwel: de Rabobank kan - totdat anders blijkt - zijn hoofd nog boven water houden.

Geef nou eens aan wat er precies mis is, in plaats van wedervragen te stellen. Niet alle gebruikte technieken en innovaties van de laatste jaren zijn slecht en niet alle producten zijn waardeloos. Ik hoor niets over de flinke positie die de Rabobank heeft op de agrarische sector (wellicht niet een spannend, maar wel een constant en degelijk rendement). Ook over de coöperatieve structuur hoor ik niets, afgezien van jouw statement dat alle banken hetzelfde zijn (wat dús niet zo is...).

Maar ja, wedervragen stellen, dossiers koppelen en metaforen gebruiken is een gebruikelijke tacktiek voor mensen die menen gelijk te hebben zonder het zelf te kunnen onderbouwen. (vgl. politici, profeten en profvoetbaltrainers)

Als alles op jou afkomt, zit jij op de verkeerde baan.

ik zat laatst te kijken op cbs en zag dat we in de jaren 70 of 80 een deflatieperiode haddenquote:Op maandag 16 februari 2009 04:11 schreef kraakschandaal het volgende:

Gebeurde dat al eerder?

Ja eind jaren 70 en begin jaren 80 ging het ook helemaal mis, was nog net geen big depression maar scheelde niet veel, op dit moment is er goeg aan de hand om van een ernstige instorting van het geld te spreken en altijd groei met verzonnen geld blijkt niet te werken.

1/10 Van de rappers dankt zijn bestaan in Amerika aan de Nederlanders die zijn voorouders met een cruiseschip uit hun hongerige landen ophaalde om te werken op prachtige plantages.

"Oorlog is de overtreffende trap van concurrentie."

"Oorlog is de overtreffende trap van concurrentie."

dat was i.i.g. niet begin jaren 80: toen was de inflatie dusdanig dat de regering en de centrale bank (DNB) zich genoodzaakt zagen om de rente flink op te stuwen, tot wel 13% op hypotheken en 11% op spaarrekeningen...

Als alles op jou afkomt, zit jij op de verkeerde baan.

Bronquote:Depression Dynamic Takes Hold as Markets, Banks Revisit 1930s

By Rich Miller

March 9 (Bloomberg) -- The U.S. economy’s vital signs may not confirm a diagnosis of depression. The symptoms increasingly point to one.

As in the Great Depression, world trade is collapsing, wealth is evaporating and the banking system is broken. Deflation is a growing threat as companies slash production, pay and prices. And leaders worldwide are having difficulty making headway in halting the self-perpetuating decline.

“We are tracking 1929-1930,” says Barry Eichengreen, a professor of economics and political science at the University of California, Berkeley.

The result: This contraction may leave a lasting imprint on the economy and society, just as the Depression did. In the wake of the devastation of the 1930s, Americans swore off stocks, husbanded their own resources and looked to the government for help. Now, another generation might draw some of the same lessons from the deepest economic collapse of their lifetime.

“This is going to scar the collective psyche,” says Mark Zandi, chief economist at Moody’s Economy.com in West Chester, Pennsylvania. “People will become much more conservative in borrowing, lending and investing.”

There’s no official definition of what qualifies as a depression. In the 1930s, the unemployment rate rose to 25 percent and the economy shrank by more than a quarter.

No economist forecasts a return to the breadlines and shantytowns of that era, even as the economy gets closer to some of the metrics academics cite as constituting a depression, if not a “great” one.

Little Likelihood

Nobel Prize-winning economist Robert Barro defines a depression as a 10 percent fall in per-capita gross domestic product and consumption. The Harvard University professor sees roughly a 30 percent chance of that occurring now.

The economy contracted at a 6.2 percent annual rate in the last quarter of 2008 and will shrink at a 7 percent rate in the first three months of 2009, projects Jan Hatzius, chief U.S. economist at Goldman Sachs Group Inc. in New York.

Bradford DeLong, a former Treasury official who is now a professor at Berkeley, says a depression is a two-year period with unemployment at 10 percent or above. He says that’s possible, though not likely. The jobless rate rose to 8.1 percent in February, a 25-year high.

Some industries are already in a depression, led by housing, where the decline accelerated in recent months as the credit crisis intensified. During the last four years, residential investment is down by 37 percent. That compares with an 80 percent drop in spending on home building from 1929 to 1932.

‘Most Difficult’

“The past five months have been among the most difficult in U.S. economic history,” Robert Toll, chief executive of Horsham, Pennsylvania-based Toll Brothers Inc., said Feb. 11, after the largest U.S. luxury homebuilder reported a 51 percent sales drop.

In the auto industry, U.S. sales have fallen 55 percent from their July 2005 peak. Production of cars and trucks plunged in January to an annual rate of 3.9 million, the lowest since the Federal Reserve began keeping records in 1967, and 67 percent below the January 2005 level.

Things are so bad that auditors have questioned the ability of General Motors Corp., the biggest U.S. automaker, to continue as a going concern.

U.S. motor vehicle output slumped 75 percent from 1929 to 1932, according to statistics in the book “American Automobile Workers 1900-1933,” by Joyce Shaw Peterson.

‘Automotive Depression’

“We are in an automotive depression,” said Efraim Levy, an equity analyst for Standard & Poor’s in New York.

The financial-services industry has also been decimated. Since the crisis began in the middle of 2007, institutions worldwide have racked up $1.2 trillion in credit losses and writedowns. Announced job cuts have topped 280,000.

“You’ve had a major disruption of the financial system, just like the 1930s,” says Mark Gertler, a New York University professor who collaborated on research about the Depression with Fed Chairman Ben S. Bernanke. In the 30s, more than 10,000 banks went bust.

That disruption is making it hard for Bernanke and his fellow policy makers to get much traction in their efforts to stop the economic decline. Strapped with losses, banks are hoarding capital rather than lending.

This type of breakdown happens only two or three times a century and can lead to a “downward vortex” in which weaknesses in the economy and the financial industry feed on each other and are difficult to break, Lawrence Summers, director of the White House’s National Economic Council, said Feb. 26. “It’s the kind of vicious cycle Franklin Roosevelt talked about,” he told a forum in Arlington, Virginia.

Collapse of Jobs Market

Particularly worrying, says Stanford University professor Robert Hall, is the collapse of the jobs market. Over the past four months, payrolls have plunged 2.6 million.

Summers has also voiced concern about a return of deflation, which wreaked havoc on the economy during the Great Depression. As wages fell back then, workers had a harder time paying their debts, aggravating the banking industry’s woes.

In an echo of those troubles, GM, FedEx Corp. and casino company Wynn Resorts Ltd. are among businesses slashing pay for more than 100,000 workers as they cut costs to counter declining demand.

There are other echoes. Since hitting a peak in October 2007, the Dow Jones Industrial Average has fallen 54 percent. Over a similar length of time -- from 1929 to 1931 -- the average fell 55 percent. It ultimately dropped 89 percent from its 1929 high before beginning to recover in mid-1932.

Stock Market Free-Fall

Combined with collapsing house prices, the free-fall in the stock market will destroy $23 trillion worth of U.S. wealth, reckons Lawrence Lindsey, a former senior White House official who now heads his own consulting company in Arlington, Virginia.

Like the Great Depression, the current economic decline is global. The International Monetary Fund says this will be the first time since World War II that the U.S. and other industrial nations will suffer a simultaneous decline in their economies.

Worldwide trade is falling fast as the credit crunch curbs financing for exporters and importers. The volume of merchandise trade plunged at an annual rate of 22 percent in the fourth quarter from the third, according to the CPB Netherlands Bureau for Economic Policy Analysis. The peak-to-trough decline from 1929 to 1932 was 35 percent, as countries slapped big tariffs on imports.

“We’re in a depression, and we need policy makers to make the right decisions to ensure that it does not become great,” says Kevin H. O’Rourke, a professor at Trinity College in Dublin, who has studied the trade issue.

Quicker Response

Government officials, especially in the U.S., are moving more rapidly to tackle the turmoil than their counterparts did during the early years of the Great Depression. Bernanke has cut the benchmark interest rate to as low as zero, while President Barack Obama won congressional approval of a $787 billion stimulus package.

Massachusetts Institute of Technology professor Peter Temin says the trouble is that the economy seems to be collapsing faster than policy makers are reacting. “They’ve only done enough to cushion the downturn,” says Temin, author of the book “Lessons from the Great Depression.”

That leaves the U.S. -- and the rest of the world economy - -in danger of being mired in an extended period of little or no growth, much like that which afflicted Japan during the 1990s. Eichengreen says such an outcome would be equivalent to a depression.

Enduring Marks

Whatever it’s called, the economy’s continuing deterioration will likely leave enduring marks. U.S. households are already rebuilding savings in response to the crisis. The savings rate rose to 5 percent in January, the highest in almost 14 years.

“They’re buying what they need, and they’re being very smart about how they spend their money,” Myron Ullman, chief executive officer of Plano, Texas-based J.C. Penney Co., said on Feb. 20, after the third largest U.S. department-store chain forecast its first quarterly loss in almost five years.

In a Feb. 27 memo, “The Return of the Frugal Consumer,” Goldman Sachs economist Andrew Tilton projected a savings rate exceeding 8 percent by the end of 2010.

Americans may also turn more conservative about where they keep their money. Merrill Lynch & Co. says U.S. bonds owned by individuals likely will account for 2 percent of households’ financial assets by 2013, up from 0.2 percent now.

“We’re in the midst of a massive economic and financial crisis,” former Fed Chairman Paul Volcker said at a Columbia University conference on Feb. 20. “We’re going to hear reverberations about this for a long time.”

It is important to distinguish between a stupid person and a shit head. A stupid person simply can't process the information , a shit head is intelligent but his mind is full of garbage.

Als RABO beursgenoteerd was geweest, warebn ze ook voor de bijl gegaan, bij de RABO is de ellende niet zichtbaarquote:Op maandag 16 februari 2009 10:48 schreef Goverman het volgende:

Wat er zo goed is aan de Rabobank? Dat ze zo'n beetje de enige bank zijn die niet bij Wouter heeft hoeven aankloppen.

^^ Dat zou dus een van de dingen kunnen zijn die Rabobank wel goed doet: niet naar de beurs gaan en leden hebben in plaats van aandeelhouders... Lijkt mij toch al wel een verschilletje. Overigens krijgt ook de Rabobank nog wel een tik mee, maar ik denk dat ze deze crisis wel door komen.

De grafiek is interessant: 85% daling t.o.v. het hoogste punt (in de grote depressie). Wanneer we dat gaan toepassen op de AEX-index en nemen we het record uit 2000 (701.38 punten), dan komen we uit op een laagste punt van 105.21 punt. Nemen we het punt van augustus 2008 (560) punten en doen er dan 85% vanaf dan komen we uit op een laagste punt van 84 punten...

De grafiek is interessant: 85% daling t.o.v. het hoogste punt (in de grote depressie). Wanneer we dat gaan toepassen op de AEX-index en nemen we het record uit 2000 (701.38 punten), dan komen we uit op een laagste punt van 105.21 punt. Nemen we het punt van augustus 2008 (560) punten en doen er dan 85% vanaf dan komen we uit op een laagste punt van 84 punten...

Als alles op jou afkomt, zit jij op de verkeerde baan.

Bronquote:China May Press G-20 to Guard Its U.S. Assets, Researcher Says

By Li Yanping

March 24 (Bloomberg) -- China’s leaders may press at the Group of 20 summit for specific steps to protect its more than $1 trillion of dollar assets as U.S. fiscal policies risk sparking a “currency war,” a senior Chinese researcher said.

The dollar weakened after the Federal Reserve said March 18 it would buy as much as $300 billion of Treasuries and the U.S. this week outlined plans to buy as much as $1 trillion of illiquid bank assets.

U.S. purchases of Treasuries are “irresponsible” because they may weaken the dollar, Li Xiangyang, of the government- backed Chinese Academy of Social Sciences, told a forum in Beijing today. “Chinese leaders are likely to articulate their concern to their U.S. counterparts strongly and ask for specific measures.”

.......

;

De pot verwijt de ketel

Nu behalve China iedereen aan competitive devaluation doet vindt China het ineens niet meer leuk

Het frapante is dat competitive devaluation een vorm van protectionisme is. In de crisis jaren 30 gebeurde dat vooral via invoerheffingen. De politici zeggen dat ze protectionisme willen vermijden omdat dit de great depression zou hebben verergerd. Maar tussen hetgeen ze zeggen en wat ze werkelijk doen liggen gaten als oceanen zo groot.

It is important to distinguish between a stupid person and a shit head. A stupid person simply can't process the information , a shit head is intelligent but his mind is full of garbage.

BBquote:Mayo Says Bank Loan Losses Will Exceed Great Depression Levels

By Nick Baker

April 6 (Bloomberg) -- Mike Mayo, who left Deutsche Bank AG to join Calyon Securities, assigned an “underweight” rating to banks on expectations that loan losses will exceed levels from the Great Depression.

“While certain mortgage problems are farther along, other areas are likely to accelerate, reflecting a rolling recession by asset class,” Mayo wrote in a report today. “New government actions might not help as much as expected, especially given that loans have been marked down to only 98 cents on the dollar, on average.”

Mayo gave "sell" ratings to BB&T Corp., Fifth Third Bancorp, KeyCorp, SunTrust Banks Inc. and U.S. Bancorp, while "underperform" ratings were assigned to Bank of America Corp., Citigroup Inc., Comerica Inc., JPMorgan Chase & Co., PNC Financial Services Group Inc. and Wells Fargo & Co.

Slechts 2% afgeschreven van de leningen

Ze kunnen ook moeilijk anders omdat alle US banken anders insolvabel zijn op 2 of 3 na. Het Myth to market model zal weinig helpen omdat dat meer afschrijving zal zijn dan 2%.

It is important to distinguish between a stupid person and a shit head. A stupid person simply can't process the information , a shit head is intelligent but his mind is full of garbage.

mooi staatlje creatief taalgebruik natuurlijk, maar het meerendeel zal dan ook niet defaulten op de leningen. Een deel wel ja, maar een groot deel niet.quote:Op maandag 6 april 2009 14:47 schreef digitaLL het volgende:

[..]

BB

Slechts 2% afgeschreven van de leningen

Ze kunnen ook moeilijk anders omdat alle US banken anders insolvabel zijn op 2 of 3 na. Het Myth to market model zal weinig helpen omdat dat meer afschrijving zal zijn dan 2%.

BBquote:Default Count Rises to Highest Since Great Depression

By John Glover

April 7 (Bloomberg) -- Thirty-five companies defaulted in March, the highest number in a single month since the Great Depression, according to Moody’s Investors Service.

The rate at which speculative-grade corporate borrowers worldwide failed to meet their obligations rose to 7 percent from 4.1 percent at the end of last year, Moody’s said in a report today. So far this year, 79 companies rated by Moody’s have defaulted, the New York-based ratings firm said.

Almost $1.3 trillion of losses and writedowns at financial institutions worldwide, combined with the deepest economic slowdown since World War II, have weakened companies’ finances, reducing their ability to pay debt. The global default rate will peak at 14.6 percent in the final quarter of this year, Moody’s predicted, lower than last month’s 15.3 percent forecast.

“There was a triangle of leverage between companies, banks and investors that was higher than at any time in history,” said Gary Jenkins, a strategist at Evolution Securities Ltd. in London. “It’s clear the default rate is going to be significant.”

In the U.S., the default rate at the end of the first quarter was 7.4 percent, up from 4.5 percent at the end of 2008, and in Europe it jumped to 4.8 percent from 2 percent.

European defaults are expected to peak at 21 percent in the fourth quarter, down from the 22.5 percent the ratings firm’s model calculated last month.

Defaults “will remain at an elevated rate,” the report said. The forecast for the peak rate has been reduced “in the last couple of months as high-yield bond spreads have declined moderately,” according to Moody’s.

In the leveraged loan market, 24 issuers rated by Moody’s defaulted in the first quarter of this year, all in North America, up from 11 a year earlier, according to the report. The rate was 4.5 percent, up from 3.5 percent at the end of the previous quarter and 1.5 percent a year ago, according to Moody’s.

It is important to distinguish between a stupid person and a shit head. A stupid person simply can't process the information , a shit head is intelligent but his mind is full of garbage.

Vooral dit:

quote:European defaults are expected to peak at 21 percent in the fourth quarter, down from the 22.5 percent the ratings firm’s model calculated last month.

"If you want to make God laugh, tell him about your plans"

Mijn reisverslagen

Mijn reisverslagen

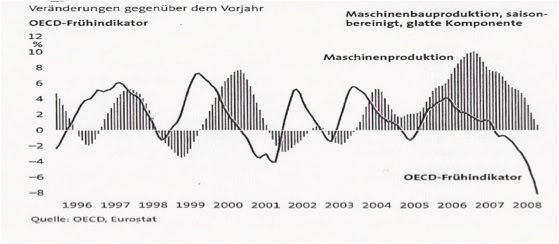

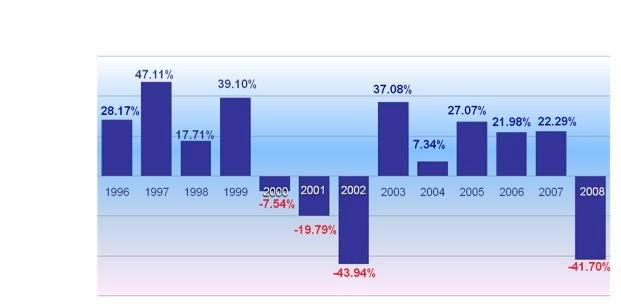

Het gaat sneller bergafwaards dan tijdens het begin van de grote depressie van de jaren 30

Begrotingstekorten

Geld in de economie "gepomd"

Bron

Begrotingstekorten

Geld in de economie "gepomd"

Bron

It is important to distinguish between a stupid person and a shit head. A stupid person simply can't process the information , a shit head is intelligent but his mind is full of garbage.

Het zijn andere tijden hè? Ik ben echt heel benieuwd hoe erg het gaat worden. Dat het heel erg gaat worden lijkt me overduidelijk, de val van de dollar is onvermijdelijk geworden maar ik ben heel benieuwd hoe het met de rest van de wereld gaat daarna...

For great justice!

Het is godsonmogelijk dat de westerse wereld door kan gaan met lenen.nl , we hebben alles verkocht, alles verpand, en de schatkist is door derden (EU) geclaimdquote:Op maandag 20 april 2009 19:26 schreef Q. het volgende:

Het zijn andere tijden hè? Ik ben echt heel benieuwd hoe erg het gaat worden. Dat het heel erg gaat worden lijkt me overduidelijk, de val van de dollar is onvermijdelijk geworden maar ik ben heel benieuwd hoe het met de rest van de wereld gaat daarna...

[ Bericht 0% gewijzigd door henkway op 20-04-2009 23:06:00 ]

Je kan je afvragen of hier geen oorlog van komt uiteindelijk. Was hitler nu echt het kwaad? Het volk was in de grip van een onmogelijke schuldenlast (voornamelijk bij Frankrijk en Engeland), en daar kwam de redder... Die het land wou /kon redden? Iemand die echt van het duitse volk hield? Wordt China de volgende grote vijand wanneer amerika haar schulden niet meer kan terug betalen? En is het volk nog altijd even dom om als schapen, hun redder te volgen? Aangezien martelingen zonder problemen konden gebeuren, en nadat is bewezen dat Irak geen massa vernietigingswapens had, en ondanks dat- het amerikaanse volk nog altijd niet hun afgunst hebben laten blijken, kan de regering doen wat ze willen? Mini voorbeeldje; Bos was de grote lul, totdat hij onze (grote) angst (gedeeltelijk) wegnam, is hij opeens weer heel erg populair..

Maar goed 1 voordeel, nu hebben we atoombommen, dus die stap lijkt vrij groot om te nemen.

Maar dit lijkt nog altijd ver weg.. bedoel we hebben het echt nog niet slecht!

[ Bericht 3% gewijzigd door Billary op 20-04-2009 20:44:19 ]

Maar goed 1 voordeel, nu hebben we atoombommen, dus die stap lijkt vrij groot om te nemen.

Maar dit lijkt nog altijd ver weg.. bedoel we hebben het echt nog niet slecht!

[ Bericht 3% gewijzigd door Billary op 20-04-2009 20:44:19 ]

Het kan heel snel gaan. Heel snel...quote:Op maandag 20 april 2009 20:12 schreef Billary het volgende:

Maar dit lijkt nog altijd ver weg.. bedoel we hebben het echt nog niet slecht!

For great justice!

BBquote:U.S. Economy: Leading Index Shows Recovery Many Months Away

By Bob Willis

April 20 (Bloomberg) -- The index of U.S. leading economic indicators fell more than forecast in March, signaling what may be the longest recession in the postwar era will extend into the second half of the year.

The Conference Board’s gauge, which points to the direction of the economy over the next three to six months, fell 0.3 percent after a 0.2 percent drop in February. The gauge hasn’t risen since June.

Rising unemployment and tight credit mean recent gains in consumer spending, the biggest part of the economy, will probably not be sustained. Stocks dropped as a report by Bank of America Corp. raised concern Americans will keep falling behind on loan payments.

....

The recession that began in December 2007 already matches the longest since 1933, and the 6.3 percent decline in fourth- quarter GDP was the biggest since 1982. The downturn has cost 5.1 million jobs and economists surveyed by Bloomberg forecast the unemployment rate will rise to 9.5 percent by the end of the year.

It is important to distinguish between a stupid person and a shit head. A stupid person simply can't process the information , a shit head is intelligent but his mind is full of garbage.

Wat een slecht filmpje (filmpje is eigenlijk wel goed maar de titel slaat nergens op), allereerst is de volgorde momenteel precies omgekeerd, financiele instellingen hebben grote afschrijvingen moeten doen op leningen (hypotheken) die zij hadden verstrekt, een situatie tot stand gekomen vanwege 'mal-investments' door een kunstmatig laag rentetarief gehanteerd door de centrale bank (een sterk bewijs hiervoor is de grote hoeveelheid variabele hypotheken die zijn versterkt, de Fed heeft namelijk de grootst controle op de kortlopende rentetarieven, variabele hypotheken waren dus extra voordelig). Het gevolg is een sterke teruggang van het aantal kredieten dat verstrekt wordt, banken hebben dat geld namelijk zelf hard nodig om niet insolvabel te raken.quote:Op maandag 20 april 2009 20:12 schreef Billary het volgende:

Maar dit lijkt nog altijd ver weg.. bedoel we hebben het echt nog niet slecht!

Doordat in de reële economie veel assets zijn gefinancierd met leningen, mede als gevolg van de gunstige tarieven waardoor geleend kon worden maar ook als het gevolg van fiscale stimulatie van het financieren van assets met leningen, komen nu ook veel bedrijven die onderdeel zijn van de reële economie in de problemen omdat herfinancieren veel moeilijker is geworden. De vraaguitval is slecht zijdelings een probleem want indien de activa gefinancierd zouden zijn met eigen vermogen zou er geen noodzaak zijn tot het afbetalen van leningen waardoor men ook niet insolvabel kan raken (in dat geval zou een onderneming gewoon stoppen met produceren als de prijzen (marginaal product) dalen onder de gemiddelde variabele kosten).

De daling van de productiviteit is dus niet leidend maar volgend, bovendien drukt de FED lang niet zoveel geld bij als in de Weimarrepubliek het geval was en daarnaast komt dat geld nog niet terecht in de reeele economie waardoor het haar inflatoire effecten nog niet tot uiting kunnen komen. In de Weimarrepubliek werd het gedrukte geld rechtsstreeks bij de consument afgeleverd ten gevolge de inkomstenondersteuning om de stakers van inkomen te blijven voorzien.

[ Bericht 2% gewijzigd door Bolkesteijn op 21-04-2009 01:07:28 ]

A glimmer of hope?

The worst thing for the world economy would be to assume the worst is over

http://www.economist.com/(...)fm?Story_ID=13527685

The worst thing for the world economy would be to assume the worst is over

http://www.economist.com/(...)fm?Story_ID=13527685

http://www.mrwonkish.nl Eurocrisis, Documentaires, Economie

Dat kan alleen als de media grove fouten gaat maken zoals ten tijde van de bank run van Northern Rock en dat zie ik de media globaal gezien niet nog een keer doen.quote:

People once tried to make Chuck Norris toilet paper. He said no because Chuck Norris takes crap from NOBODY!!!!

Megan Fox makes my balls look like vannilla ice cream.

Megan Fox makes my balls look like vannilla ice cream.

BBquote:Global Crisis ‘Vastly Worse’ Than 1930s, Taleb Says

By Shiyin Chen and Netty Ismail

May 7 (Bloomberg) -- The current global crisis is “vastly worse” than the 1930s as financial systems and economies worldwide have become more interdependent, “Black Swan” author Nassim Nicholas Taleb said.

The global economy is heading into a “big deflation,” though the risks of inflation are increasing as governments print more money, Taleb said at a conference in Singapore today. Gold and copper may “rally massively” as a result, he added.

“The gravity of the situation is vastly worse than the thirties,” Taleb said. “Navigating the world is much harder than in the 1930s.”

The International Monetary Fund last month cut its world economic growth forecasts and said the global recession will be deeper and the recovery slower than previously predicted as financial markets take longer to stabilize. The world economy will contract 1.3 percent this year, the IMF said.

“This is the most difficult period of humanity that we’re going through today because governments have no control,” Taleb told the conference organized by Bank of America-Merrill Lynch. “They had in the 1930s. Today they have no control.”

....

It is important to distinguish between a stupid person and a shit head. A stupid person simply can't process the information , a shit head is intelligent but his mind is full of garbage.

Ik maak me grote zorgen over de toekomst.

En dat het zover heeft kunnen komen is ook iets om niet vrolijk van te zijn.

En dat het zover heeft kunnen komen is ook iets om niet vrolijk van te zijn.

Dus de media heeft dadelijk alles gedaan, onze financiele jongens die al die leveraging grappen bedacht hebben is niets te verwijten.quote:Op zaterdag 25 april 2009 18:44 schreef sitting_elfling het volgende:

[..]

Dat kan alleen als de media grove fouten gaat maken zoals ten tijde van de bank run van Northern Rock en dat zie ik de media globaal gezien niet nog een keer doen.

quote:Op dinsdag 23 december 2008 21:23 schreef digitaLL het volgende:

[..]

Bron

Steeds meer vergelijkingen met de Great Depression komen boven drijven. Een van de dingen die nog niet gebeurt is betreft een dramatische prijsval van landbouwprodukten.

Mjah, kan nog komen natuurlijk

Nuquote:Brussel lanceert EU-werkgroep over melkprijs

Uitgegeven: 5 oktober 2009 14:44

Laatst gewijzigd: 5 oktober 2009 14:58

BRUSSEL - De Europese Commissie stelt een werkgroep in om te bekijken hoe de melkprijs stabieler kan worden. EU-commissaris Mariann Fischer Boel (Landbouw) heeft dat maandag gemeld aan ministers van Landbouw van de EU-landen.

ANP

Boerenprotest 5 oktober

slideshow

De ministers hadden een bijeenkomst ingelast wegens de historisch lage handelsprijs voor melk.

De prijs die de boeren krijgen is in een jaar bijna gehalveerd tot 20 cent per liter. Boeren zegggen zo failliet te gaan en protesteren al maanden.

De liberale EU-commissaris Fischer Boel meldde de ministers dat de melkprijs inmiddels iets is gestegen tot 26 cent, dankzij haar eerdere maatregelen.

Ze subsidieert onder meer export en opslag.

Een dramatische prijsval in landbouwproducten hebben we nu dus ook.

Geld maakt meer kapot dan je lief is.

Het zijn sterke ruggen die vrijheid en weelde kunnen dragen

Het zijn sterke ruggen die vrijheid en weelde kunnen dragen

Dat hoorde ik vandaag toevallig ook vertellenquote:Op maandag 5 oktober 2009 15:18 schreef Digi2 het volgende:

[..]

[..]

Nu

Een dramatische prijsval in landbouwproducten hebben we nu dus ook.

|

|