Wel als die multinationals de regels bepalen en daarmee de politiek in feite lam leggen.quote:Op woensdag 8 november 2017 06:17 schreef Pietverdriet het volgende:

[..]

Je klinkt als iemand met veel,frustraties maar weinig inhoud.

Als de schatkist al wordt leeggeplunderd is dat door de politiek, niet door multinationals die zich voor belastingvoordeel in NL vestigen.

Its hard to win an argument against a smart person, but it's damn near impossible to win an argument against a stupid person

quote:Guy Verhofstadt duikt op in Paradise Papers

Europese liberale leider zegt van niets te weten

Guy Verhofstadt, voorzitter van de liberale fractie in het Europees parlement waartoe ook D66 en de VVD behoren, is in het verleden bestuurder geweest bij een groep die voorkomt in de Paradise Papers. Dat zegt de PVDA (een socialistische Belgische partij, niet te verwarren met de Nederlandse PvdA). Zulks meldt de Belgische krant Het Laatste Nieuws dinsdagavond.

Verhofstadt was tot april 2016 bestuurder van rederij Exmar. Nu blijkt dat CEO Nicolas Saverys met meerdere bedrijven in de Paradise papers opduikt. Verhofstadt zegt tegenover VTM Nieuws zelf geen weet te hebben van verdachte filialen die opduiken in die database.

“In het Europees parlement spelt Verhofstadt de les aan iedereen. Maar als bestuurder van de holding Exmar kreeg hij 60.000 euro per jaar. Waarom heeft hij nooit bezwaar gemaakt tegen de schimmige offshore-constructies van dochter Exmar Offshore Ltd. op de Bermuda’s?”, vraagt Peter Mertens, voorzitter van de PVDA, zich af.

Foute mannen.. zoveel foute mannen. Het zijn altijd weer mannen. Hebberige kerels. Hadden we maar meer vrouwen die wat voor het zeggen hebben. Mannen zijn kinderachtig bezig in deze.

vrijdag 9 december 2016 15:58 schreef Ringo het volgende:

Welke discussie? Ik zie alleen maar harige kerels die elkaar de rug inzepen.

Welke discussie? Ik zie alleen maar harige kerels die elkaar de rug inzepen.

quote:Op woensdag 22 november 2017 01:45 schreef Bart2002 het volgende:

Foute mannen.. zoveel foute mannen. Het zijn altijd weer mannen. Hebberige kerels. Hadden we maar meer vrouwen die wat voor het zeggen hebben. Mannen zijn kinderachtig bezig in deze.

As the officer took her away, she recalled that she asked,

"Why do you push us around?"

And she remembered him saying,

"I don't know, but the law's the law, and you're under arrest."

"Why do you push us around?"

And she remembered him saying,

"I don't know, but the law's the law, and you're under arrest."

quote:Guardian to fight legal action over Paradise Papers

Offshore firm at heart of story, Appleby, is seeking damages and has demanded Guardian and BBC hand over documents

The Guardian is to defend robustly a legal action seeking to force the disclosure of the documents that formed the basis of its Paradise Papers investigation.

The offshore company at the heart of the story, Appleby, has launched breach of confidence proceedings against the Guardian and the BBC.

In legal correspondence, Appleby has also demanded that the Guardian and the BBC disclose any of the 6m Appleby documents that informed their reporting for a project that provoked worldwide anger and debate over the tax dodges used by individuals and multinational companies.

Appleby is also seeking damages for the disclosure of what it says are confidential legal documents.

The documents were leaked to the German newspaper Süddeutsche Zeitung, which shared them with a US-based organisation, the Pulitzer-prize-winning International Consortium of Investigative Journalists (ICIJ).

The ICIJ coordinated the Paradise Papers project, which included 380 journalists from 96 media organisations across 67 countries. The consortium included the New York Times, Le Monde, the ABC in Australia and CBC News in Canada.

The project revealed details of the complex arrangements and offshore activities of some of the world’s richest people and companies.

It has already provoked a formal inquiry by the Australian tax office, a review by HMRC into VAT schemes on the Isle of Man, and calls from the EU finance commissioner, Pierre Moscovici, for changes in the law to stop “vampires” avoiding paying tax.

Appleby has said the documents were stolen in a cyber-hack and there was no public interest in the stories published about it and its clients.

It has brought legal action against only the Guardian and the BBC, both UK-based media organisations.

The Guardian said it intended to defend the legal action.

A spokesman for the Guardian said the claim could have profound consequences, and deter British media organisations from undertaking serious, investigative journalism in the public interest.

He said: “We can confirm that a claim has been issued against the Guardian. The claim does not challenge the truth of the stories we published. Instead it is an attempt to undermine our responsible public interest journalism and to force us to to disclose documents that we regard as journalistic material.

“This claim could have serious consequences for investigative journalism in the UK. Ninety-six of the world’s most respected media organisations concluded there was significant public interest in undertaking the Paradise Papers project and hundreds of articles have been published in recent weeks as a result of the work undertaken by partners. We will be defending ourselves vigorously against this claim as we believe our reporting was responsible and a matter of legitimate public interest.”

A BBC spokesperson said: “The BBC will strongly defend its role and conduct in the Paradise Papers project. Our serious and responsible journalism is resulting in revelations which are clearly of the highest public interest and has revealed matters which would otherwise have remained secret. Already we are seeing authorities taking action as a consequence.”

Appleby said it was “obliged to take legal action”.

It said: “Our overwhelming responsibility is to our clients and our own colleagues who have had their private and confidential information taken in what was a criminal act. We need to know firstly which of their – and our – documents were taken.

“We would want to explain in detail to our clients and our colleagues the extent to which their confidentiality has been attacked. Despite repeated requests the journalists have failed to provide to us copies of the stolen documents they claim to have seen. For this reason, Appleby is obliged to take legal action in order to ascertain what information has been stolen.”

Free Assange! Hack the Planet

[b]Op dinsdag 6 januari 2009 19:59 schreef Papierversnipperaar het volgende:[/b]

De gevolgen van de argumenten van de anti-rook maffia

[b]Op dinsdag 6 januari 2009 19:59 schreef Papierversnipperaar het volgende:[/b]

De gevolgen van de argumenten van de anti-rook maffia

Hilarisch hoe dit soort mensen continu aan het projecteren zijn.quote:Op maandag 18 december 2017 21:53 schreef Papierversnipperaar het volgende:

calls from the EU finance commissioner, Pierre Moscovici, for changes in the law to stop “vampires” avoiding paying tax.

As the officer took her away, she recalled that she asked,

"Why do you push us around?"

And she remembered him saying,

"I don't know, but the law's the law, and you're under arrest."

"Why do you push us around?"

And she remembered him saying,

"I don't know, but the law's the law, and you're under arrest."

De EU produceert tegenwoordig zelf ook misselijkmakende propaganda over belastingen in plaats van dit aan de lidstaten over te laten.

Er zijn verschillende versies van deze site, en deze versie is specifiek bedoeld om kinderen tussen de 9 en 12 te indoctrineren.

[ Bericht 48% gewijzigd door heiden6 op 08-01-2018 07:37:07 ]

https://europa.eu/taxedu/childquote:What is this website about?

The name of this portal – TAXEDU – is derived from the words ‘Tax’ and ‘Education’.

TAXEDU is a European Union pilot project. Its aim is to educate young European citizens about tax and how it affects their lives.

The portal targets three age groups with tailored information:

Children: an explanation of what taxes are and the benefits everyone experiences day-to-day. The section includes some surprising and fun facts about tax from around Europe to make learning fun. The language is simple and accessible.

Teenagers: a description of what taxes are and the benefits for everyday life. This section includes more detail than the one for children, as well as concrete examples that fit with teenagers’ interests (downloading music, buying online, etc.).

Young adults: information relevant to this particular phase in life, as young people make the transition to adulthood (do they have to pay tax when they start university, launch their business, work in another country, etc.).

Information is conveyed through games, e-learning material and microlearning clips so that European youngsters can learn about tax in its different forms, and the issues associated with it (tax fraud, tax evasion, etc.) in a fun and engaging way.

The teachers’ corner offers resources, tips and tricks on teaching about tax and its benefits at school.

Why this website?

The objectives of the TAXEDU web-portal are to:

contribute to the fiscal education of young European citizens;

reduce tax evasion and fraud across Europe, through better information and education in this area;

provide European citizens with information on the services and facilities that are made possible through tax (education, healthcare, etc.).

Who are we?

The project was led by the European Parliament and the European Commission (Directorate General for Taxation and Customs), while national tax administrations participated. Most importantly, young Europeans were consulted during the creation of this site, and provided feedback on its learning content.

Er zijn verschillende versies van deze site, en deze versie is specifiek bedoeld om kinderen tussen de 9 en 12 te indoctrineren.

[ Bericht 48% gewijzigd door heiden6 op 08-01-2018 07:37:07 ]

As the officer took her away, she recalled that she asked,

"Why do you push us around?"

And she remembered him saying,

"I don't know, but the law's the law, and you're under arrest."

"Why do you push us around?"

And she remembered him saying,

"I don't know, but the law's the law, and you're under arrest."

quote:HMRC 'struggling to deal with fallout of Paradise Papers leak'

Parliament’s spending watchdog says agency faces ‘potentially catastrophic consequences’ juggling effects of the leak, Brexit and 15 other programmes

HM Revenue and Customs is struggling to cope with a growing workload, including investigating revelations contained within the Paradise Papers, according to parliament’s spending watchdog.

The public accounts committee has warned that it is “far from confident” that the tax authority has sufficient resources to scrutinise claims published in the Guardian last year arising from a leak of 13.4m files.

In a report released on Thursday, MPs concluded that the Paradise Papers leak had highlighted the “potentially dubious practices of many high-profile individuals and corporations” that use offshore tax havens.

The committee said the tax authority was having to make tough decisions about the allocation of its own resources, while implementing Brexit changes and 15 major programmes across government.

Meg Hillier, the chair of the committee, said that HMRC’s “high-wire act” is facing “potentially catastrophic consequences” for taking on too many tasks at the same time.”

She added: “HMRC accepts something has to give and it now faces difficult decisions on how best to use its limited resources – decisions that must give full consideration to the needs of all taxpayers.

“These are serious, pressing challenges for HMRC, requiring swift and coordinated action in government.”

Most of the documents – 6.8m – relate to a law firm and corporate services provider that operated together in 10 jurisdictions. Among dozens of revelations, which were published in 96 media outlets, the papers showed how the Queen’s private estate invested in a Cayman Islands fund and the offshore dealings by Donald Trump’s cabinet members.

The report points out that a previous leak of data, known as the Panama Papers, resulted in 66 criminal or civil investigations and an expected additional tax revenue of £100m.

MPs have recommended that the tax authority should respond to the latest disclosures by March and tell the committee how much additional revenue is likely to be at stake.

“HMRC now claims to be better equipped to deal promptly with any large-scale leak of data,” the report said.

“However, the speed with which cases can be investigated depends on whether they are civil or criminal, as criminal cases will take longer to prepare. We are far from confident that HMRC has sufficient resources to deal with the full scale of the recent allegations.”

It points out that HMRC has requested documentation but has not yet received a response.

A Guardian spokesman said the tax authority has powers to request data from the organisations concerned and investigate these matters.

“We have only had access to the data through our partners at the International Consortium of Investigative Journalists (ICIJ),” he said. “We understand that HMRC has already been in touch with them.”

Tax officials have told the committee that projects linked to the UK’s EU withdrawal could add 15% to its workload, the report said.

The committee said the transformation programme under way at HMRC – involving office closures, relocation of staff into 13 regional centres and digitalisation of tax returns – is “not deliverable” as originally envisaged due to the increased pressures. It added that the agency estimates it will fall short of its 2020 target of £717m savings by £10m.

It gave HMRC a deadline of April to set out how it will respond to growing pressures.

Revenue sources said that the BBC, ICIJ and the Guardian have not yet handed over documentation related to the Paradise Papers, which could take months to analyse.

An HMRC spokesperson said: “Following the Paradise Papers data leak, HMRC continues to look very closely at the information disclosed in the public domain, to see if it reveals anything new that could add to existing leads and investigations.

“Since 2010, HMRC has secured an extra £160bn by tackling tax avoidance, evasion and non-compliance, including £2.8bn from customers who tried to hide money abroad to avoid paying what they owe.”

Free Assange! Hack the Planet

[b]Op dinsdag 6 januari 2009 19:59 schreef Papierversnipperaar het volgende:[/b]

De gevolgen van de argumenten van de anti-rook maffia

[b]Op dinsdag 6 januari 2009 19:59 schreef Papierversnipperaar het volgende:[/b]

De gevolgen van de argumenten van de anti-rook maffia

Het is maar goed dat ze zo verschrikkelijk inefficiënt zijn.quote:

As the officer took her away, she recalled that she asked,

"Why do you push us around?"

And she remembered him saying,

"I don't know, but the law's the law, and you're under arrest."

"Why do you push us around?"

And she remembered him saying,

"I don't know, but the law's the law, and you're under arrest."

Goed hè een overheidsdienst die veel geld binnenbrengt heeft geldgebrekquote:Op zondag 14 januari 2018 00:32 schreef heiden6 het volgende:

[..]

Het is maar goed dat ze zo verschrikkelijk inefficiënt zijn.

In Baden-Badener Badeseen kann man Baden-Badener baden sehen.

Voorschotje nemen alvast..dat ze bepaalde belangrijke mensen niet kunnen gaan vervolgen wegens capaciteitsgebrek.

ik ben niet gek.. ik ben volstrekt niet gek, ik ben helemaal niet gek... ik ben een nagemaakte gek

gooi alles weg neem een besluit, doe als het moet alles opnieuw

gooi alles weg neem een besluit, doe als het moet alles opnieuw

quote:Paradise Papers revealed 'commoditisation' of tax avoidance

Australian Taxation Office says investigation of data leak has identified 731 individuals and 344 corporate entities so far

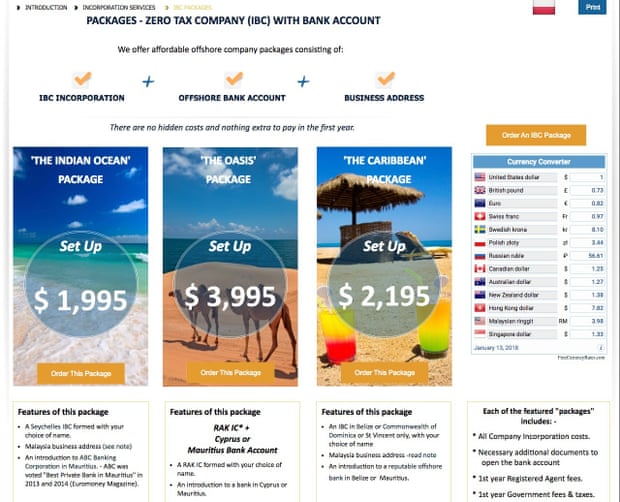

The Paradise Papers have helped to reveal a global industry of tax avoidance packages that are offered to wealthy individuals much like holiday packages, the Australian tax authorities say.

The Paradise Papers have also revealed how offshore tax providers have expanded dramatically since the financial crisis, growing super-sized networks of accountants, lawyers and tax specialists that dwarf similar networks from a decade ago.

Mark Konza, deputy commissioner at the Australian Taxation Office, said: “These [leaks] send a clear message to those people who are involved with these types of service providers: if you’re getting involved in any arrangement that relies on secrecy then you can’t rely on secrecy.

“What we’re seeing [increasingly] is there are ordinary people who are becoming sick of some of the things they see happening.”

Two months after the Paradise Papers were published, he has told Guardian Australia that the ATO’s investigation of the data leak is already looking at 731 Australian taxpayers and 344 corporate entities.

HMRC 'struggling to deal with fallout of Paradise Papers leak'

Read more

He said the ATO was still cross-matching the data in the Paradise Papers with the larger Panama Papers, which were released in 2016, but the information extracted so far was proving significant.

“I would expect that as the data is interrogated further and cross-matched with other datasets [those numbers of individuals will increase],” he said.

He said it was too early to say if individuals identified in the Paradise Papers were already known to the ATO. But the information gleaned from the Paradise Papers had revealed the extent to which intermediaries such as banks, law firms, and accountants have commoditised tax avoidance, he said.

“The Panama Papers and the Paradise Papers led us to think about, well, what’s happening with these intermediaries that are encouraging this type of behaviour?” he said.

“When we focused on the intermediaries, that’s when we began to see … the commoditisation of tax [avoidance].

“We were aware that there were companies providing these services, but I think what we’ve learnt is the commoditisation, with the internet, has continued apace.

“We’ve also identified that after the global financial crisis, there was a round of mergers and acquisitions in the offshore provider industry itself, so while there are thousands of these offshore service providers we’ve identified that some large networks have begun to emerge.

“One company we know has offices in 46 jurisdictions around the world, through constant merger and acquisition activity.”

Konza said tax specialist intermediaries that help individuals avoid tax often specialise in particular regions of the world, such as the Caribbean and the Atlantic Ocean, or Asia and the Pacific Ocean. He said some of these intermediaries were brazenly promoting tax avoidance “packages” to individuals exactly like holiday packages.

A simple internet search shows how such packages can be promoted.

A typical tax “package” will help an individual set up a company in one jurisdiction, then help that company obtain a bank account in a second jurisdiction and a business address in a third jurisdiction.

“They would say they give you the arrangements, they give you the tools, but what you do with them is up to you. So they try to stay morally ambivalent,” he said.

“Some websites have various case studies on them, showing it’s possible to be done. One of my favourite case studies ends by saying ‘Is it legal? It’s pretty grey’,” he said.

He said the ATO’s investigations sparked by the release of the Panama Papers and the Paradise Papers had an “iconic value” inside Australia’s tax system, because the subsequent tax crackdowns helped to reassure the community that individuals and companies were having to pay their lawful tax.

“In a lot of these leaks you’re seeing people who have just become dissatisfied and thought enough’s enough, and so they’ve either leaked the information themselves or they might be an IT specialist who just grabs the data off the system, or we’ve had leaks from people who were outraged and they saw some firms and they decided to hack the firms from the outside.”

“We get data releases quite regularly. In between the Panama Papers and the Paradise Papers, I think we’ve had about 13 different data releases from around the world.

“We’re trying to get that message out to people: if you’re relying on secrecy you can’t rely on secrecy,” he said.

Konza said another thing to emerge from investigations of the Panama Papers and Paradise Papers was the growing demand for so-called aged companies.

“There’s a real market in companies that have been incorporated for some time, which are then used to make an arrangement appear to be long-standing, or appear to pre-date certain tax changes” he said.

Guardian to fight legal action over Paradise Papers

Read more

“So you could get a 20-year old Singaporean corporation, it will cost you twenty or thirty thousand dollars … no reflection on the Singaporeans, it’s just a company that’s been registered, there’d be aged Australian companies as well that you could probably buy.

“The oldest company that we’ve seen for sale is a 1902 Nevada corporation from the US, which was almost US$200,000.

He said these revelations were helping revenue authorities.

“It makes you query basic facts about where has a company been for most of its existence – was it really an operating company or was it a vintage company bought off the shelf?” he said.

“So there’ve been a few things that have come out of the papers already.”

Free Assange! Hack the Planet

[b]Op dinsdag 6 januari 2009 19:59 schreef Papierversnipperaar het volgende:[/b]

De gevolgen van de argumenten van de anti-rook maffia

[b]Op dinsdag 6 januari 2009 19:59 schreef Papierversnipperaar het volgende:[/b]

De gevolgen van de argumenten van de anti-rook maffia

quote:Tax abuse crackdown brings in only a third of expected £1bn

Freedom of Information request reveals some attempts to close avoidance loopholes have failed

A crackdown on offshore tax avoiders has only recovered about a third of the £1bn that the government had predicted, according to estimates.

Figures from HMRC suggest that a series of measures to tackle avoidance will bring in £349m a year – £650m a year less than had been hoped for.

Other measures aimed at closing tax avoidance loopholes have also failed to generate the revenues that had been expected, undermining assurances from ministers that were made following the Paradise Papers expose.

The figure appears in a list of updated estimates provided by HMRC to the independent Office for Budget Responsibility over the last two years and released under a Freedom of Information request by the Labour party.

Labour’s shadow chancellor, John McDonnell, said these figures exposed “the utter failure” of the government to ensure the super-rich and big corporations are paying their fair share in tax.

“This could be just the tip of the iceberg,” he said. “After the Paradise Papers revelations last year, we know the government are quick to press release action, but slow to delivery on it, but now they have been shown to not even deliver on what they originally promise.”

Concerns over tax abuses in the age of austerity has led successive government to promise crackdowns on tax evasion and aggressive tax avoidance schemes.

Over the past eight years, measures have been launched to tackle the use of offshore accounts to hide money from the UK taxman, including agreements with Switzerland, Liechtenstein and other low-tax regimes to recover unpaid tax.

In total, these measures were forecast to bring in an extra £997m a year to the Treasury. However, a new forecast in September 2017, after most of the measures had closed, downgraded that figure to £349m a year.

Labour says a total of 28 anti-avoidance measures introduced under the under the coalition and Conservative government were bringing in less than expected, and that the gap between the tax take originally expected from them and the revised forecasts totalled £2.1bn, or 25%.

Measures that are now expected to raise less than originally forecast include a package of moves to tackle base erosion and profit shifting, where companies artificially move profits to locations with low tax rates.

These, which included new taxes on diverted profits and royalties were expected to bring in a total of £515m a year but are now expected to raise £175m less each year.

Accelerated payments, whereby investors in avoidance schemes are asked to pay any disputed tax upfront, were forecast to bring in £1.1bn annually, £154m more than the latest forecasts suggest has been raised.

Some measures have yielded more than the original forecasts predicted, and offset some of the £2.1bn difference.

For instance, the sums raised through cracking down on the way company takeovers are structured have been revised up to 554% of the original forecast. Preventing companies from avoiding stamp duty by cancelling and reissuing shares during a takeover is forecast to make the Treasury £425m a year against an original figure of £65m.

McDonnell said the downwards revision of other forecasts showed the Conservatives were “dragging their feet” on tax avoidance. “Their failed action on this issue discloses that deep down tax avoidance for them is an acceptable practice for the super-rich and big business whose interests they serve,” he said.

“We need an urgent change of direction from Philip Hammond. It’s not acceptable any longer for our public services like the NHS to go on being underfunded, while the Tories refuse to take serious action to properly clamp down on tax avoidance and evasion.”

The party is calling on the government to adopt policies it laid out in its election manifesto last year, including open registers of company owners in the UK’s overseas territories and an immediate public inquiry into tax avoidance.

The FOI showed new laws and a taskforce to crack down on the use of offshore companies by property developers have raised less than hoped for, with new forecasts revised down by 26%, or £133m. However, the introduction of a higher stamp duty rate and capital gains tax on residential properties bought through offshore firms have been more profitable than predicted. The annual tax take from these measures was revised up from £68m to £208m.

In November, the prime minister, Theresa May, responded to the revelations of the Paradise Papers investigation by saying HMRC had brought in an extra £160bn in tax revenues since 2010.

A spokesman for the Treasury said: “The UK has one of the lowest tax gaps in the world and we continue to take action to ensure everyone pays the tax they owe. Since 2010, we have secured and protected over £175bn for our public services that would have otherwise gone unpaid.”

Free Assange! Hack the Planet

[b]Op dinsdag 6 januari 2009 19:59 schreef Papierversnipperaar het volgende:[/b]

De gevolgen van de argumenten van de anti-rook maffia

[b]Op dinsdag 6 januari 2009 19:59 schreef Papierversnipperaar het volgende:[/b]

De gevolgen van de argumenten van de anti-rook maffia

Belachelijke framing om de term 'abuse' te gebruiken,maar dat valt te verwachten van The Guardian.quote:

Lekker projecteren.quote:aggressive tax avoidance schemes

As the officer took her away, she recalled that she asked,

"Why do you push us around?"

And she remembered him saying,

"I don't know, but the law's the law, and you're under arrest."

"Why do you push us around?"

And she remembered him saying,

"I don't know, but the law's the law, and you're under arrest."

quote:Mossack Fonseca law firm to shut down after Panama Papers tax scandal

Firm at the center of controversy over tax evasion cites economic and reputational damage in announcement

A Panamanian law firm at the center of the Panama Papers scandal has announced it is shutting down.

The directors of Mossack Fonseca blamed the economic and reputational damage inflicted by its role in the global tax evasion debacle for the closure.

Leaked files from the company were the basis of the Panama Papers investigation in early 2016, provoking a global scandal after showing how the rich and powerful used offshore corporations to evade taxes.

“The reputational deterioration, the media campaign, the financial circus and the unusual actions by certain Panamanian authorities, have occasioned an irreversible damage that necessitates the obligatory ceasing of public operations at the end of the current month,” the firm said in a statement on Wednesday.

Mossack Fonseca said a skeleton staff would remain in order to comply with requests from authorities and other public and private groups.

Nonetheless, the law firm said it would continue “fighting for justice”, adding it would continue to cooperate with authorities.

Founded in 1977 by the German lawyer Jürgen Mossack, it was the world’s fourth-biggest provider of offshore services at the time the scandal erupted. Mossack was joined by the Panamanian lawyer Ramón Fonseca and a third director, the Swiss lawyer Christoph Zollinger, was later added.

Until the publication of the Panama Papers, it had been mostly obscure despite sitting at the heart of the global offshore industry and acting for about 300,000 companies. More than half were registered in British tax havens – as well as in the UK.

Last month, Panamanian prosecutors raided the offices of Mossack Fonseca, seeking possible links to Odebrecht, Latin America’s largest engineering company. The Brazilian construction firm has admitted to bribing officials in Panama and other countries to obtain contracts in the region between 2010 and 2014.

Ramón Fonseca denied last month that his firm had a connection to Odebrecht, while accusing the Panamanian president, Juan Carlos Varela, of directly receiving money from Odebrecht.

Varela has denied that he took any money from Odebrecht.

Free Assange! Hack the Planet

[b]Op dinsdag 6 januari 2009 19:59 schreef Papierversnipperaar het volgende:[/b]

De gevolgen van de argumenten van de anti-rook maffia

[b]Op dinsdag 6 januari 2009 19:59 schreef Papierversnipperaar het volgende:[/b]

De gevolgen van de argumenten van de anti-rook maffia

As the officer took her away, she recalled that she asked,

"Why do you push us around?"

And she remembered him saying,

"I don't know, but the law's the law, and you're under arrest."

"Why do you push us around?"

And she remembered him saying,

"I don't know, but the law's the law, and you're under arrest."

Interessante website.quote:

Charity is injurious unless it helps the recipient to become independent of it.

Socialisten vechten allang niet meer tegen het kapitalisme maar tegen de realiteit.

Socialisten vechten allang niet meer tegen het kapitalisme maar tegen de realiteit.

As the officer took her away, she recalled that she asked,

"Why do you push us around?"

And she remembered him saying,

"I don't know, but the law's the law, and you're under arrest."

"Why do you push us around?"

And she remembered him saying,

"I don't know, but the law's the law, and you're under arrest."

In principe is er niets mis mee om kinderen iets bij te leren over belasting. Ik ben benieuwd wat kinderen zullen zeggen als 40 procent van hun zakgeld word afgenomen en dat ze geen zeggenschap hebben over hoe dat geld word uitgegeven.quote:Op maandag 8 januari 2018 07:04 schreef heiden6 het volgende:

De EU produceert tegenwoordig zelf ook misselijkmakende propaganda over belastingen in plaats van dit aan de lidstaten over te laten.

[..]

https://europa.eu/taxedu/child

Er zijn verschillende versies van deze site, en deze versie is specifiek bedoeld om kinderen tussen de 9 en 12 te indoctrineren.

[ afbeelding ]

|

|

Op

Op